Part 1 – What is filtering?

Part 2 – Building a simple filter with NSR

Part 3 – Filtering at Lending Club

Part 4 – Filtering at Prosper

Note: building a filter from scratch is completely optional. Most never do it. In fact, most investors don’t filter at all and still earn great returns. Those who do filter loans typically just use basic filters (like Inquiries=0) or copy the filters of experienced investors like myself (see my filters) or those over at the Lend Academy forum.

That said, understanding how a filter is constructed can be really helpful for understanding what filtering is and how it works. As a result, my purpose in writing this article is twofold. First, it is to help explain filtering in general by showing you how one is built. Second, it is to enable you to do it yourself (if you possess the time and interest). Of course, the best way to see a filter built is in my free video: Building a Peer to Peer Lending Filter.

Let’s get started.

NickelSteamroller and The Open Data of P2P Lending

Michael Philips and Rocco Galgano are two talented developers who have been active in the peer to peer lending space for some time. Originally, Michael ran a site that back tested Lending Club’s data, and Rocco ran a site that back tested Prosper’s data. They joined forces and launched NickelSteamroller (NSR) in early 2014, a site that back tests both Lending Club and Prosper.

Back testing is when we statistically analyze the historical loan data.

What is back testing? All of peer to peer lending’s data is open to the public (loans defaulted vs. loans paid back), so back testing is when we statistically analyze this data. The NSR tool gathers all of the historical data for us and allows us to break it down by whatever variables we choose. Want to see how business loans have performed at Lending Club in 2013? NSR can tell you that. Want to see how borrowers from Florida performed at Prosper in 2014? NSR can tell you that too.

Today we’re going to use their back testing tool to create a filter. Note: NickelSteamroller actually has lots of functions that we won’t delve into in this post. For more on NSR read “NickelSteamroller 2.0 and the Courageous Data of P2P Lending“.

Back Testing Lending Club on NSR

Navigate to the back testing tool by going to NickelSteamroller, navigating to the Analytics tab and clicking on the Lending Club Back Testing / Filters link.

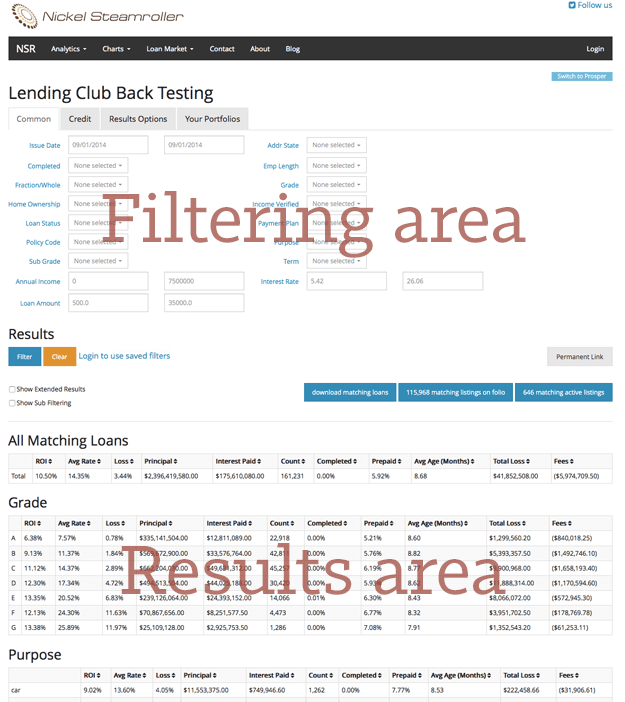

The tool is divided into two sections: the filtering area and the results area.

The filtering area (seen below) is where we can add different variables like income, loan amount, and many others:

The results area (seen below) is where we see the historical results of this filter, such as return on investment (ROI) or default/loss rates. This section also displays breakdowns of the filter along further variables. For example, you can see below how a filter performs within the various loan grades.

4 Steps to Create a Lending Club Filter from Scratch

For this example, we’re only going to use data from loans in mid-2013 until today. Lending Club’s credit model is constantly changing and being updated, so the younger data we use, the better the chances that future loans will perform the same way. That said, we can’t use data that is too young or else the loans haven’t had enough time to perform. But setting the minimum date to 06/06/2013 gives us a set with an average age of 11 months, which I feel balances these two needs quite well.

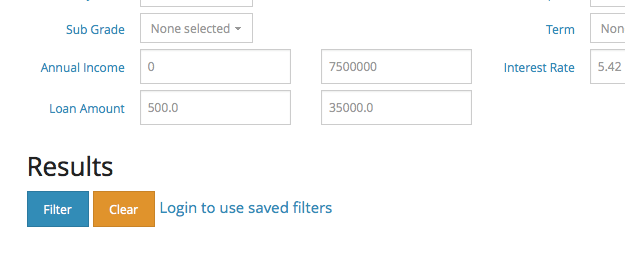

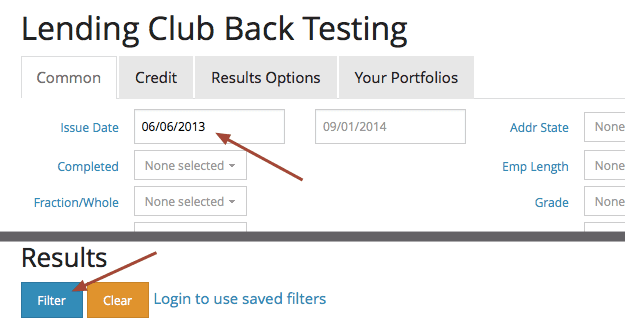

Step 1: Filter the entire loan history for mid-2013 through today (set the minimum date to 06/06/2013 as seen below).

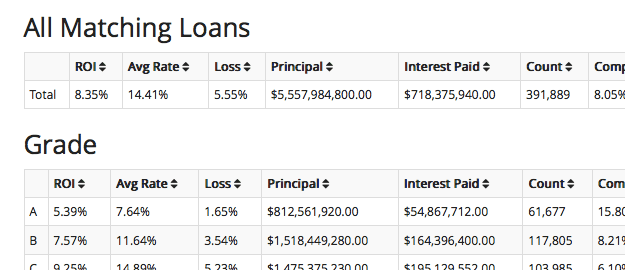

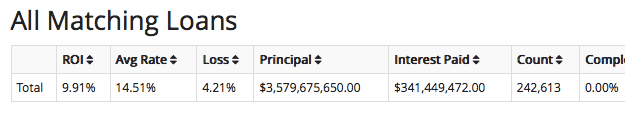

The ROI for this data is in the All Matching Loans area (seen below). Investing in all the Lending Club loans since mid-2013 would have netted you a 9.9% return.

Step 2: Examine the breakdowns: grade, purpose, FICO, annual income, and inquiries. Then pick different filtering variables that have higher than average ROI. For many, this data encourages people to choose C-G grade loans since those have higher than average returns (though it also means taking on more risk).

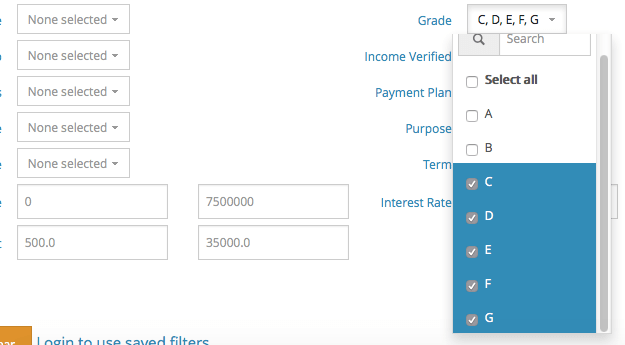

For example, I can isolate just C-G loans by going up to the top and checking the boxes for C-G under ‘Grade’.

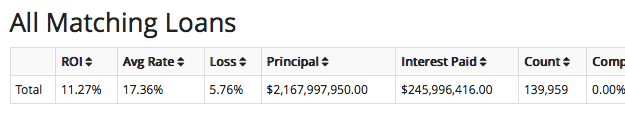

After clicking the blue Filter button, the ROI jumps from 9.91% to 11.27%.

Step 3: If you’re satisfied with this, then make a note of the variables you used and go to step 4. However, if you’re wanting to increase the ROI further, go back to step 2 and examine additional breakdowns at the bottom of the tool (you can add more breakdowns under the ‘Result Options’ tab at the top).

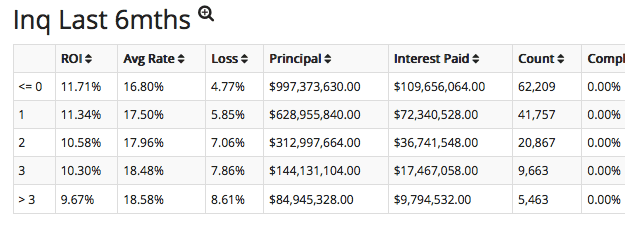

For example, we see that inquiries in the past six months earn a much better ROI than the rest.

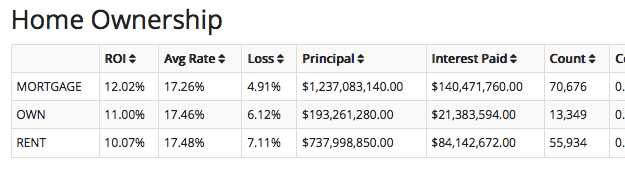

Secondly, I see that borrowers with a mortgage also returned a higher ROI.

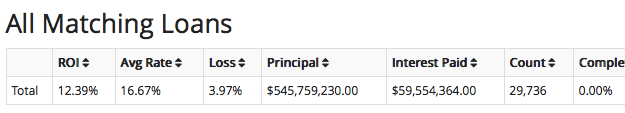

By adding these variables to the top of the tool and reclicking Filter, my overall ROI jumps from 11.27% to 12.39%.

Just by adding low-grade loans and adding a few filters, we have increased our overall return almost 2.5% above average. Cool, right?

Step 4: Move over to Lending Club or Prosper with your new filter and invest in loans (see parts 3 and 4 of this series).

5 Important Things to Remember

#1: Make sure breakdowns/filters have 1000+ historical loans

There are a few things to keep in mind. First of all, a breakdown needs at least 1000 loans to be statistically significant. For example, if borrowers from Tennessee in May of 2013 returned a wonderful 15%, yet there are only four loans in this data set, obviously that is not a very trustworthy conclusion. Every single filter variable needs 1000 loans backing it up.

#2: Tighter filters take longer to invest

You may discover a great filter with solid statistical evidence that you could use to earn a great return. However, you may fail to find any loans with these variables at Prosper or Lending Club. This is often because your filter is too tight. This can especially be a problem is you’re trying to invest a sizable amount all at once, say more than $10,000. In these situations, it can be wise to loosen your filtering variables until the lump sum is fully invested, and then ratchet the variables back up once you simply have to reinvest returns.

#3: Filters change over time

The underwriting and credit policies of these companies are always changing, so it is really important that you log back into NickelSteamroller throughout the year and check to see if your filter is still valid. More often than not, things have changed, and you will need to find a different set of variables to use.

#4: The loan data is young, returns are inflated

The filter we made in this article (C-G loans, Inq=0, Mortgagers) gave us a historical ROI of 12.4%. However, that return is not an indication of what you may actually earn with this filter. First, the loans it is analyzing are not fully seasoned, so there’s a bit of a lack of accuracy there. Secondly, the credit policy of Lending Club (and Prosper) has likely changed since mid-2013, so this filter may not even work anymore.

Peer to peer filtering involves a lot of guesswork.

This is another example that proves how much guesswork goes into peer to peer filtering. We are simply hoping that future loans will perform the same way. Remember, typical returns at Lending Club and Prosper are between 5-9%. Our hope, through filtering, is simply to arrive on the higher side of those returns.

#5: Filtering is dying

Finally, it is important to note that filtering is dying. Remember that we are simply taking advantage of weaknesses in these companies loan grade assignments. As Lending Club and Prosper continue to get better at accurately giving their loans the correct interest rates, our ability to game their imperfection will decrease. It is completely possible that, by 2016, filtering as a strategy may be dead in the water, an anachronism of peer to peer lending’s humble beginnings.

For the time being, however, I feel filtering loans remains a great practice to help increase returns.

Related video: Building a P2P Lending Filter (12:19)

[image credit: ‘Vienna Bread – Dough kneaded‘ by Rebecca Siegel CC-BY 2.0]

Creating your own filter is complex. In fact, quite a few things this site suggests are complex. Also, it is pointed out that portfolios with over 400 minimum sized loans have a much higher chance of performing better….all of these things lead me to the idea that there could be financial managers or managed funds in this field, just like their are for most all other investment areas. If I wanted to start an investment club with my friends whereby we could put 20% of our investments pooled together (at about say $2000 each to start) We could gain economies of scale in using these third party tools, the time of learning and creating strategies, broader diversification, etc.

Do you know if there are any rules from prosper/LC barring this, or any laws regarding this?