I was recently interviewed by Joe Saul-Sehy for the Stacking Benjamins podcast. At one point in the interview, Joe mentioned he was unable to invest because he lives in Texas, a state that is closed to both Lending Club and Prosper investors [Update: as seen below, Texas is now open!]. This is really frustrating for Joe, because he is a big fan of peer to peer loans.

Joe is not alone. Millions of people like him can’t borrow or invest in loans because they live in closed states like Texas. But the situation is different for everybody. Some people find their state is closed to Prosper but open with Lending Club.

The maps below show the open and closed states for borrowers and investors.

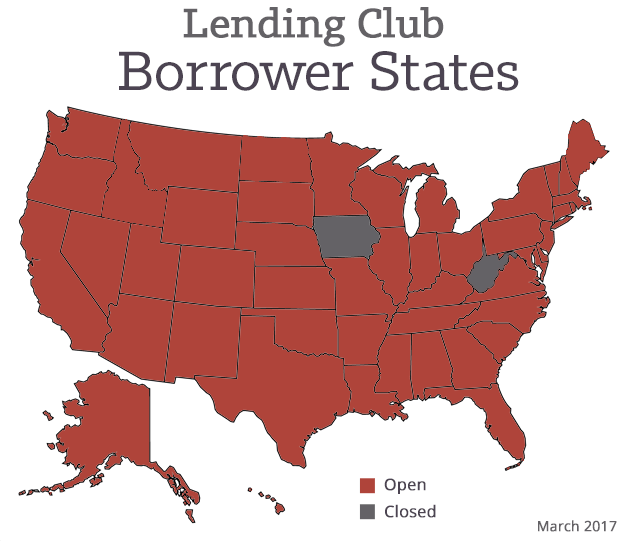

Borrowers: 48 States Open to Lending Club

As seen in the map below, almost every state allows people to get a loan through Lending Club. Just two states (Iowa and West Virginia) forbid it.

It’s always good to compare rates between lending companies, so check below to see if your state is also open with Prosper.

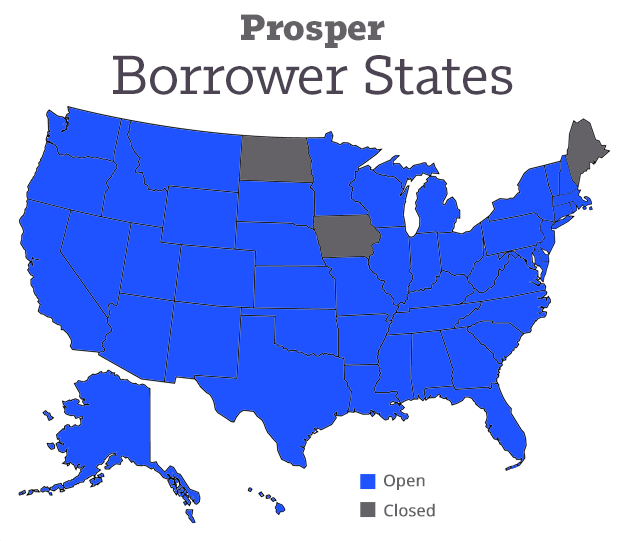

Borrowers: 47 States are Open to Prosper

In the map below you can see that every state in the US allows Prosper loans except Iowa, Maine, and North Dakota.

Live in a Lending Club or Prosper state?

Check your rate at both, go with the lower rate.

Won’t hurt your credit score.

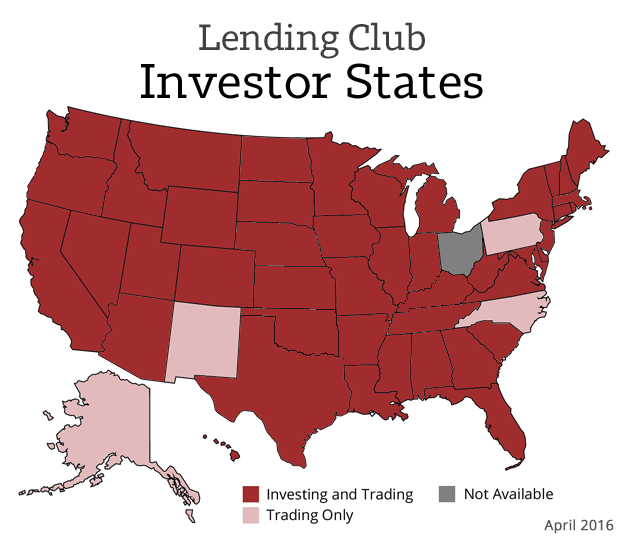

Investors: 45 States Open to Lending Club

The situation for investors is more complicated. Thankfully, most of the United States can invest in peer to peer loans.

Forty three states are open for investing through Lending Club: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota,Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New York, North Carolina, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming. The District of Columbia is open to investing as well.

Live in a Lending Club investor state?

Open an account

(Signup is free and secure)

Is your state closed to Lending Club? Chances are you live in one of the four pink states (like Pennsylvania or New Mexico) open to trading on the Foliofn secondary market. Trading is more complicated than simple investing, but can still offer an investor great returns. Read: How to Invest through Folio

Do you live in Alaska? Your state is open to Prosper even though it’s closed to Lending Club.

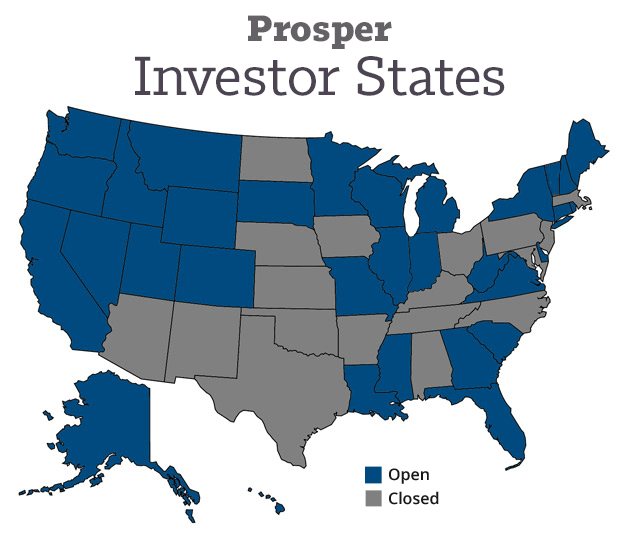

Investors: 32 States Open to Prosper Marketplace

Thirty two states are open for investing through Prosper: Alaska, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New York, Oregon, Rhode Island, South Carolina, South Dakota, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin and Wyoming.

Live in a Prosper investor state?

Open an account

(Signup is free and secure)

Live in a state closed to Prosper investors? Check the Lending Club states above.

Is your state open to both? You’re in luck!

If your state is open both to Lending Club and Prosper, you get your pick. Read this: Lending Club versus Prosper for Investors

I am an investor with both companies (see my returns), and believe this diversification helps spread my risk. Each platform has different underwriting criteria (standards for who gets to borrow money), so by spreading my investment across them both I make my overall investment more stable and rewarding.

Why Doesn’t Ohio Legalize Peer to Peer Lending?

Notice how some states do not allow any peer to peer lending? Why is this? The answer is complicated. The short version: these loans have been legally defined as securities by the SEC, yet they are not part of any national securities exchange (like the New York Stock Exchange).

As a result, both Lending Club and Prosper have had to apply to each state for access, and each state’s security regulators have different opinions. Some, like Washington State where I live, have welcomed peer to peer lending with open arms. Others (like Ohio) are concerned that this investment could hurt their investors, so they have not yet approved access.

Thankfully, a “blue sky exemption” may change this situation in the coming year.

When Will More States Open to Lending Club?

Lending Club CEO Renaud Laplanche

In February I sat down with Renaud Laplanche, Lending Club’s CEO, and asked him about how things could change in 2015 (read the interview). He mentioned that more states could open up to Lending Club now that they are a public company traded on the New York Stock Exchange. Read: Lending Club becomes a Public Company

Lending Club believes their IPO gives them a “blue sky exemption”, which would mean they could be regulated on the national level and no longer need state by state permission. However, some states have resisted this reading of the law, and may legally challenge Lending Club’s efforts to use the blue sky exemption in this way.

As a result, the future of state eligibility is quite uncertain. If I had to guess, I do think we’ll see more states open up in 2015, but all fifty states will probably not be open for at least a few more years. [Update: many new states have indeed opened in 2015!]

Want to Help? Lobby Your State Security Regulators!

If you live in a state closed to investors, there is still much you can do. Your state’s security regulators need to know that you, a citizen of their state, feel peer to peer lending is a safe and consistent investment. As more people reach out to them, their opinions are sure to change and mature.

Click here to contact your state securities regulator. If you want to go the extra mile, you can also reach out to your state representatives here. They often have much greater sway with the security regulators than simple citizens, so their opinion definitely matters.

The fact is that these officials would offer more support Lending Club and Prosper if they knew more about them. However, peer to peer lending is still quite unknown on the national level, so many regulators are justifiably suspicious toward it. But with enough time and positive history, this situation is certain to change.

US map courtesy of: SuperTeacherWorksheets.

What happens when you move from an allowed state to a forbidden one?

We live in California now, and are planning to open a Lending Club investor account this summer. At some point in the next few years we’ll be moving to North Carolina which only allows trading not investing. I’ve been meaning to ask LC about it but figured I’d ask here since I’m sure others are interested in the answer.

So this is what happened… I have been with Prosper for five years while living in GA and SC. I just moved to MD, and when I updated my address in the profile settings, the webpage informed me that Maryland was an ‘unsupported state. Therefore, I cannot deposit any further money into the account nor recycle incoming payments into funding new loans. As the loan repayments come in, you’ll need to pull them out.

What would happen if a lender moved from a state where it was allowed to one where it wasn’t? Obviously, they could just not change their address, but that could be problematic if anything needs to be mailed, plus they still might need to pay state taxes.

Interesting question. I’m not sure, but from what I’ve heard the eligibility depends on where you are taxed. So, when moving to a prohibited state perhaps one should liquidate their positions. Great question to ask Lending Club on the phone.

Actually living this nightmare. I invest in prosper and moved from DE to PA and did not know that PA was a non-invest state. Once you move you can’t liquidate your position, it just slowly unwinds. Pretty annoying.

I’ve been investing in Lending Club loans for several years now only through the FolioFN platform. I’m still getting a hair over 9% return on my money. Can’t beat that with a savings account!

Also. I’ve been told, privately, that it may be possible to use the address of a family member who lives in an open state as your account address when opening an account on either, and then just having said family member forward you anything that might come by mail. I’ve not done this, as it seems like it’s a bit shady. However, I’ve been told that it could work. And I can’t say what the tax ramifications would be if the other state address was used to send your tax forms to the IRS. Would that mean you had to file taxes in your state and the state you were using as a mailing address?

Hi Shane. Great to hear from you.

I’m glad Folio has worked out so well for you! More people need to hear that story.

As for the situation you’re describing, legally you’re a resident of the state where you live and pay taxes. So having your mail forwarded from a family member in an open state would technically not make you eligible.

I agree, technically & legally, you’re state of residence is the one you live and pay taxes in. However, the person I was talking to was inferring that you use a relative’s address in an open state for all of your address information in the platform. As far as the platform would know, you are a resident of the open state, and not your actual state.

It’s a verification loophole of sorts. Borderline ethically, and legally. I’m not sure what the ramifications would be to taxes, etc when it came time to do those things.

I live in Ohio that does not allow; and as per your advice to open a FLIO account is a miraj; I tried lending club and it does not allow Ohio residents?

Can one start a local operation/state wide? similar to prosper or lendingclub etc and use Steamroller and get the business going? Can you tell me the pros, cons and regulatory loopholes?

you said that your friend said that Texas was closed to both prosper and lending club but on your map it has Texas opened to lending club and closed to prosper. Did Texas recently update their laws?

Yes – added Tx and Az in June per this link; http://www.prnewswire.com/news-releases/lending-club-platform-opens-to-investors-in-texas-and-arizona-300105921.html

P2P lending just got the green light in Kansas! Yaaayyy!

Just opened an IRA in Maryland for Lending Club.

My adventure begins.

Welcome!

The map says Prosper is open to Vermont investors. According to Prosper, that is no correct.

Why doesn’t Prosper lend in Iowa, Maine, and ND? What about Pennsylvania?

Every state individually gives permission to Lending Club and Prosper to operate there. Some states are stricter than others.

Prosper no longer lends to people in Pennsylvania, at least as of today.

So mine gets even more complicated. I was a lender in Oregon in Prosper and moved to NC a (non investing state). but I still own property in Oregon in the form now of a rental and pay some Oregon taxes so can I just keep my Oregon address on my prosper account, then can I keep it?

Honestly I have no idea.

“can I keep it”

Legally, you’re not supposed to do that. You’re regulated by the state where you “live”.

However, if Prosper doesn’t know that you’ve moved, they can’t react. I am only starting to investigate P2P lending, but most financial companies these days will be happy to eliminate paper mailings and send you everything electronically. If you do that, the address they have on file won’t matter much (since they’ll never send anything there).

I live in Massachusetts, and I see that prosper doesn’t allow investing in the state, but Lending Club does… Is there a reason for this? I would think the same legislation would apply to both sites?

Each company has to apply separately, and each goes through a unique legal process. So it’s possible that either Prosper just doesn’t care that much about retail investors in Massachusetts vis-a-vis the work it required to get them, or they were unable to get approved. Lending Club’s approval process was likely easier since they qualify under the Blue Sky exemption since they’re a publicly traded company on the NYSE.

I am still waiting for North Carolina to be lifted so I can start investing.

Missouri, as of 9/28/18, is no longer allowing investing with Prosper. I can\’t speak to the \’borrowing\’ side, but I have received notice that I can no longer make unsecured loan investments because I live in the state of MO.