Lending Club is a peer to peer lending company that offers loans through the internet. Unlike a traditional bank, Lending Club works by connecting borrowers who need a loan to investors who have extra cash to lend. Since there’s no banks involved, no vaults or tellers or other expensive bank things, Lending Club can pass the savings over to their borrowers in the form of lower interest rates.

But not everybody is a satisfied customer. Sometimes people apply for a loan at Lending Club yet walk away feeling upset or angry, and for many different reasons. In this article you will read about the biggest Lending Club complaints, as well as some possible solutions to these complaints.

Complaint #1: Lending Club can deny your loan application

The biggest complaint people have about Lending Club, more than all other complaints, is that their request for a loan gets denied. This can be really frustrating considering how much time it takes to fill out the application, especially if they are applying because they received an advertisement from Lending Club in the mail telling them that they were “pre-approved”.

If this is your situation, it can be helpful to remember that Lending Club is acting on the best information they have about you. Perhaps the loan application you filled out included some new negative facts that decreased your chances of getting a loan. There are a lot of possible reasons why you were originally approved but were eventually denied.

Thankfully there is a second option called Prosper. They offer almost the exact same kind of loan (up to $40,000), and people sometimes even get a lower rate through them than at Lending Club. Check your rate at Prosper by clicking here (won’t hurt your credit score).

Complaint #2: Lending Club’s interest rates can be too high

Perhaps you applied for a loan, but when Lending Club showed you your loan offer the interest rate was higher than expected (like, 15-20%). This is perhaps the most complicated part of this article, mostly because the way that Lending Club sets its interest rates is a company secret.

You see, the interest rate that Lending Club offers you is based on a large combination of factors, and nobody really knows what these factors are (except for the people who actually work at the company). What we can guess, however, is that their loan rates are probably based on the same things that most loan rates are based on: factors that make people good borrowers of money. So let’s pause for a second and ask ourselves, “What makes a good borrower?”

Simply put, a good borrower is someone who has (A) a long healthy history of paying back their loans, and (B) who has a good job to help them pay their loans back. There may be a few other things that make people good loan candidates (like renting vs. owning a home), but those are the big two, credit history and income, so let’s talk about those one by one.

Option A: Lower rates through better credit history

Your credit history is an important part of being a healthy person. It allows you to get a home mortgage or take out a loan to start a small business. Your credit report is something you should be aware of and nurture, like a garden. An entire article could be written on this section alone, but I’ll cover the main points and hopefully you can get the big picture.

The three biggest ways to improve your credit history are:

- Download your credit history

- Check your credit history for errors

- Pay back your bad debts

First, you need to go to AnnualCreditReport.com and download your report. Then take an hour or so and go through it carefully, checking each account on the report for accuracy, especially accounts that are still open. If you spot an item that is open that you do not recognize then you may have had your identity stolen. This is rare, but it does happen! You need to contact the phone numbers on your credit report as quickly as possible.

More than likely you have not had your identity stolen. Instead, you may very well find an old loan or credit card that you are certain has been paid off, but that your credit report says is late. If you call this creditor up and get them to correct their error then your credit score will likely improve!

It is very very common for people to get a bad interest rate (or get denied for a loan altogether) because of items on their credit history that are not their fault. You must to go through your credit history item-by-item and make sure it is 100% accurate. Print it off, get out that yellow marker, and take an hour to do it. Only afterward can you be confident about where you stand, financially speaking.

Finally, it’s a good idea to become current on any loans or credit cards you’ve fallen behind on. If an item on your credit history says “In collections” or “Late” (or something negative like that) then your credit score will get its biggest boost if you can fix these items.

Option B: Lower rates through more income

If you can increase the yearly income that you can report to Lending Club, you are more likely to qualify for a loan, and your interest rate is more likely to be lower. So how does one increase their income?

The easiest way is to think long and hard about how much money you actually bring in per year. I’m sure you already told them about your salary from your main job, but do you have any side income you forgot to mention? Perhaps you make a few extra thousand dollars per year babysitting or painting houses. Print out some old bank statements and think long and hard about any other ways of earning money you might have forgotten when you originally checked your rate.

Of course, the simplest way to increase your yearly income is to increase how much money you make at your job, so perhaps this is a great opportunity to sit down with your boss and negotiate that raise you’ve been on the fence about. Or maybe this is the month for you to launch that side business you’ve been meaning to start. Literally do anything to increase your yearly income. You can include this higher income next time you check your rate at Lending Club, and hopefully your new rate will be lower.

Complaint #3: Your monthly payment can be too expensive

A big complaint people have is that they get a flier from Lending Club in the mail advertising great loans, but when they check their loan offer online the monthly payment is more than they can afford. A loan offer with a high monthly payment can be frustrating, but there are a few big things you can do to lower your payment:

- Only borrow what you need

- Increase the “term” of the loan

Firstly, only borrow what you need. If you need $5,000 to pay off some medical bills then don’t borrow $10,000 just because you have the option. Only borrow what you need; this is the responsible option. It will ensure that your monthly loan payment is as small as possible.

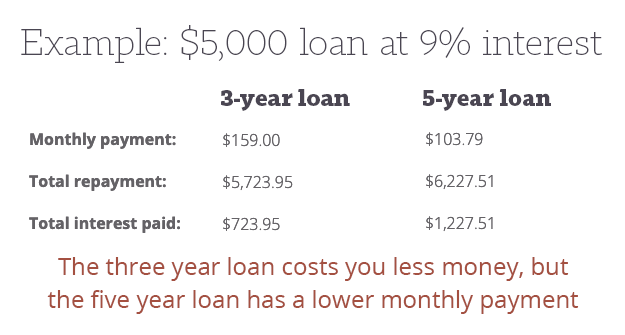

Secondly, think about increasing the “term” of the loan. The term is the length of time that you will borrow the money. For example, if you use LendingMemo’s loan calculator then you will see a 3-year $5,000 loan at 9% interest will have a monthly loan payment of $159. In contrast, a 5-year loan for the same amount ($5,000 at 9%) has a monthly loan payment of about $104, $55 less per month for the same loan:

Perhaps you don’t mind paying a little more interest overall if it means getting a monthly loan payment that is within your budget.

Complaint #4 Lending Club calls about your loan being late

This is a big deal, but it’s not totally out of the ordinary. Every year thousands of people have sudden unplanned hardships that they were not prepared for. If you become late on your loan, Lending Club will probably call you to talk about it. Sometimes this is just a problem with your bank. Maybe you switched banks and forgot to update Lending Club with your correct routing and account numbers.

But let’s say you actually are late on your loan. The best thing to do here is to take a few hours and work out your monthly budget. Look at your bank statements and credit card statements. Are there any items that you are spending money on that you don’t need, like that daily $4 latte at Starbucks ($120 per month)? Perhaps you could bring in some additional income, like renting out that extra room in your house. Whatever it is, the best way to get Lending Club off your back is to create a budget and stick to it.

If all else fails, you can always try calling Lending Club and telling them about your situation. Maybe they have a payment plan to offer you. And if you are a military veteran you might qualify for a reduced payment, so make sure to mention your veteran status to Lending Club.

Complaint #5: Lending Club asks to send them money or gift cards?

Did Lending Club ask you to send them money or a gift card to receive your loan? Sorry, but you are being scammed. Lending Club never asks for money up front. Their fee is taken from your loan after you are approved. So if you apply for a $5,000 loan and your fee is 5% then you will have $250 taken from the lump sum they send you, meaning you will have $4750 deposited into your bank from Lending Club, yet still have to pay back the full $5,000. See how that works? Lending Club never ask you for money to get a loan through them. Instead, they take their fee from your loan transfer.

Conclusion: Lending Club is a safe place to get a loan

Most people who borrow from Lending Club have a good experience. Yes, it can be frustrating to get a flier from them saying you are “preapproved” for a loan, only to get denied the loan when you check your rate online, or to get an interest rate or monthly payment that is more than you can afford. But most people who actually get loans through Lending Club have no complaints at all.

I know this from experience. I’ve taken out many loans from Lending Club myself (see my review here) and the entire process for me has always been smooth. Not only is the interest rate usually lower than a credit card, but the rate is also fixed which means it will never go up, even if you make a late payment. Finally, there is no prepayment penalty. You can always pay your loan off early without a fee.

Checking your rate takes just a minute, and is done with a soft credit check, meaning it won’t hurt your credit score. Click the button to see what sort of loan rate Lending Club offers you:

Won’t hurt your credit score.

[image credits: Julio Garciah “Cellphone”

vishpool “P1000089”

Desi “Curriculum vitae“CC-BY 2.0]

I just got approved for a loan but have not received an email with the paperwork that is needed to get the money. How long do this usually takes?

Hi Marilyn. People can always log into Lending Club and check their status there. Also check your spam folder to make sure you’re receiving Lending Club’s emails.

I just received an email from a devin kale telling me loan was approved and a verification form to fill out. They asked for bank account and my log in info to bank account. When I sign on to the web site though it does not give me any option to check the status it keeps sending me back to the check your rates page. Was this a legitimate email.

This sounds like a scam to me. ONLY fill out loan applications through the official LendingClub.com website.

I have supposedly been working with your company on a loan. They sent me a check for $702.09 to bank as restitution

I was told to go purchase Google play cards which I did. Called spoke with reginia paul . However my bank refused the check because it looked fradulent. Now they are telling me I need yo pay $600.00 for NC State taxes but asking me yo ho to a target otr Best buy and pay this. Not directly to the state. Is this normal

You are being scammed. Lending Club never asks for money or gift cards up front.

Do they ask you for your bank user name and password?

Yes, they did ask for mine too, but everything is on the up and up.

I was asked for username, password and security information then had some money deposited into my account which I was asked to return the money they gave on an American Express or Vanilla One am I being scammed?

Yes, you are being scammed. Lending Club never asks for money, gift cards, American Express cards or Vanilla One cards to get a loan from them.

I have taken out several loans with Lending Club, got a better rate than what my bank was giving me, also in order for them to verify it’s your bank account they will deposit a small amount up to a dollar in your account. LOVE THEM 😊

I totally agree with Jen, my experience with

Lending Club has been a pleasant one from beginning to end. Love Them

I just paid off a 36 month loan w months early. My experience was also pleasant from beginning to end!

Why do you need user name and password

Hi Debie. When a loan applicant provides Lending Club with their bank’s username and password, it allows Lending Club to connect their bank account to their loan, getting the funds sent over as quickly as possible. Note: Lending Club *never* asks for bank information over the phone, so people should make sure they’re using the official Lending Club website.

I constantly get “pre-approved” offers from Lending Club. When I applied a couple of days ago, they denied my application.

I applied several years ago and they denied my application then but my credit had improved in the interim so I tried again.

Still, they mail offers to me round the clock.. I may contact them and ask to be taken off the list.

Hi JD. That sounds really frustrating!

I got a call from lending tree where it says I have been approved for a 5,000 dollar everything was going smoothly until he came out and said that he was providing me with an insecure loan and he said for security measures in case I don’t pay the loan they need some some kind of security in case I don’t pay it will cost me 100 dollars and I told him another loan company already did that to me and he still that the company was working under BBB and FTC that they were ranked A+.

This is a scam. Lending Club never asks for money up front. Make sure you’re using the official Lending Club website.

I received a loan approved letter by email through lending club / Republic Bank stating I was approved for $10000. How do I know this is legit and will they contact me for my personal info or do I need to call the # they gave with a persons name?

Sounds fishy to me! Call Lending Club’s official phone number and ask them yourself: (888)596-3157. They are open from 5am to 5pm PST.

I utilized Lending Club for ease of origination. Acquired a lump to consolidate revolving credit. They were quick to approve and deposit. All very good. Loan is now paid off and account closed. If the same need arises in the future, I will probably pass on LC, Their customer service seemed sluggish to me and at times entirely unresponsive. LC was first to this market space and went public so perhaps just became lazy? My advice is to obtain a few offers and if given the option simply pass on LC. This is a competitive market space and other lenders might just deliver the whole package. Good Luck.

Hi J. I somewhat agree. I have not experienced Lending Club as lazy or unresponsive, but if a potential borrower can find a lower interest rate at a different company, then by all means they should take that option.

I recieved an email saying I could do a loan up to 5k. I called and since my credit was low, they said theyd need to send me funds that I would then turn around and purchase a Google card to repay them to boost my credit. I feel as though this was a scam so I hung up and reset all my bank info so they didnt have online access just in case. Was this person trying to scam me? The phone number was from Chicago, Illinois

Hi Britney. Yes, this is scam. Lending Club never asks for money, gift cards, or any other cards up front in order to get a loan through them. Make sure you are on the official Lending Club website by clicking here.

Note: I’m going to start deleting any comments like this, because I have already answered this question many times.

Hello. I applied for a loan and it’s been 7 days since I applied. What is the longest I can expect to wait to be approved or denied? Thanks.

Never mind. I was approved. I’m so happy. Thanks!

I applied for my 2nd loan with LC a couple weeks ago. I have a credit score in the 800s and only debt I have is car lease. I have mid 50’s income. But because my living arrangements are that a rent a room from a person, and I don’t have any utilities in my name, I was turned down for “unable to verify residence.” This morning, I spoke with LC, and they said if I changed my address on my bank statement then sent it to them, that would work. I did that – but it takes the bank 3-5 days to make that change; the girl I spoke with this morning said that was fine; but just after noon today, I received notice of adverse action…..how disheartening for a FORMERLY loyal customer. It seems the lease agreement with my landlady should have sufficed, but they said it would not. :(

Hi Patricia. I’m sorry to hear your story. That sounds really frustrating.

Consumer beware!

Do not go here for a loan. Complete runaround from customer service and incompetence of loan officers reviewing legal documents needed for loan consideration.Finally withdrew application. Worst experience ever encountered in trying to obtain a loan.

Hi Kristen. Sorry to hear you had a negative experience.

Does LC report to all three credit bureaus to help your credit score?

Hi Alexia. If a borrower actually takes out a loan from Lending Club and begins making payments, as far as I know they will report the new loan to all three agencies.

I was approved for a loan. They called me and asked me for alot of information I put on my application, as well as mobile banking information to “confirm the account is mine.” Then they said for security, they would send me a small amount first that’s not included in my loan amount, and they want me to send it back as confirmation that I’ll pay back the loan. Is this a scam?

Hi Brianna. I can’t speak to your personal situation, but know that Lending Club never asks for money to get a loan through them.

I applied using the online website. Got approved and 100 percent backed by lenders in less than 24hrs. Very positive experience and would definitely recommend Lending Club.