If you’re just starting out, there’s an immediate decision you’re faced with: should you go with Lending Club or Prosper? Both of these companies are mentioned side by side all the time, so which is right for your situation?

I remember having to make this choice myself. When I began peer to peer lending in 2011, both of these companies were an option as well, and I was confused about which to choose. What was lacking at the time was a hard look at how these companies were different, a so-called “versus” article that would help me choose the right one.

Let me say from the outset: most new investors will probably want to open their first account with Lending Club. However, there are some honest reasons someone might choose Prosper instead.

Three Ways Lending Club and Prosper are Similar

I’ll begin by showing how similar these two San Francisco-based companies are:

#1. Both are great options to begin peer to peer lending

Unlike any other company, both Prosper and Lending Club allow average unaccredited Americans to begin peer to peer lending. For those who are brand new, peer to peer lending is the large-scale lending of money to people over the internet. Instead of people borrowing from banks, they are having their loans funded by investors.

Peer to peer lending is the large-scale lending of money to people over the internet.

That’s where we come in. Investors each come in and fund a small portion of these loans, called a note. In doing so, loans as large as $35,000 can be funded by hundreds of investors all working together, and these $25 portions allow each individual investor to spread their investment across hundreds of different borrowers at a time. This way, each of us remains diversified, and our investment remains consistent (and rewarding) year by year.

In a nutshell, this is what peer to peer lending looks like for investors:

- We transfer a lump sum to Lending Club or Prosper

- This money is diversified across hundreds of different borrowers in $25 increments (notes)

- Our borrowers repay their loans month-by-month with interest

- We take these repayments and invest them into more notes

- Over time, our portfolio’s value grows via the power of compound interest

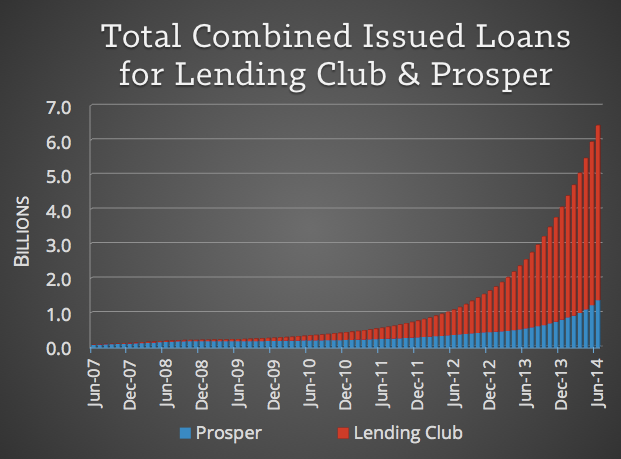

This kind of borrowing and investing is catching on like wildfire. As seen below, over $6 billion has been loaned out by investors through Prosper and Lending Club.

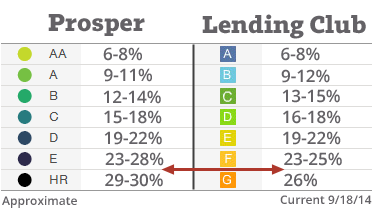

Both of these companies provide a fully-functional avenue to join this cutting-edge investment. For instance, both allow us to take on different levels of risk for our particular situation. You can choose the safer A-grade loans, or the riskier E-grade loans. Loans with an A-rating might give investors a lower return, but they are a much more trustworthy investment. E-rated loans are for riskier borrowers who are more likely to not pay their loan back, but also offer us the chance to earn a much higher return. Every investors loan grade choice will be different (read: Loan Grades).

Using our web browser, both Prosper and Lending Club allow us to invest in loans and examine our portfolio. Both companies even have retirement account options for this investment, such as a self-directed IRA. Both have all their historical loan data open for the public to examine (think: really big spreadsheets). Finally, both allow filtering of their loan pools, meaning an investor can filter out certain loans they dislike and only invest in the loans they prefer.

#2. Both Prosper and Lending Club are solid investments

This item is worth its own section: both of these companies allow investments in the solid asset class of prime consumer credit, so both of these companies offer worthwhile investments. Full stop.

What is prime consumer credit? Simply stated, it is loans to individual Americans who have good credit history. How do we know consumer credit is a good investment? Because for over thirty years the big banks have earned a great return through issuing credit cards to people. Like peer to peer loans, credit cards are simply unsecured lines of credit.

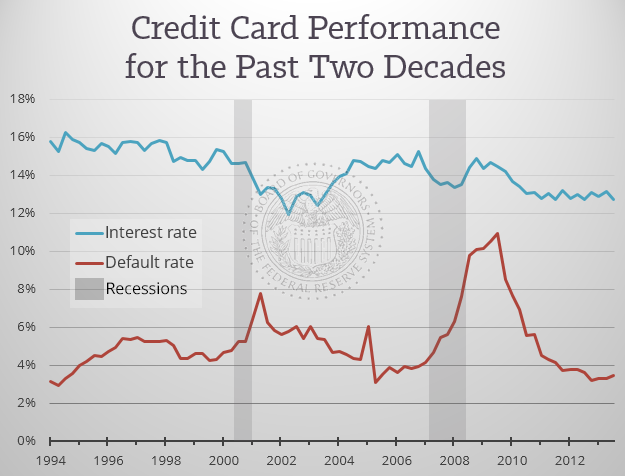

What this chart shows is the interest rate on credit cards in the US for the past twenty years. Basically, anybody who issued them earned a great return. The banks have made between an 3% and 11% return by issuing these unsecured lines of credit, and have never lost money on this investment. Read: This Investment has 20 Years of Straight Positive Returns

For the first time in history, average Americans have the chance to invest in consumer credit as well. This is the beauty of peer to peer lending. Since it simply invests in creditworthy individuals nationwide, it possesses great stability as an investment. For example, in 2008 the stock market lost around 30% of its value. However, Lending Club still managed to give investors a positive return. Read: “Why Peer to Peer Lending is Amazing“.

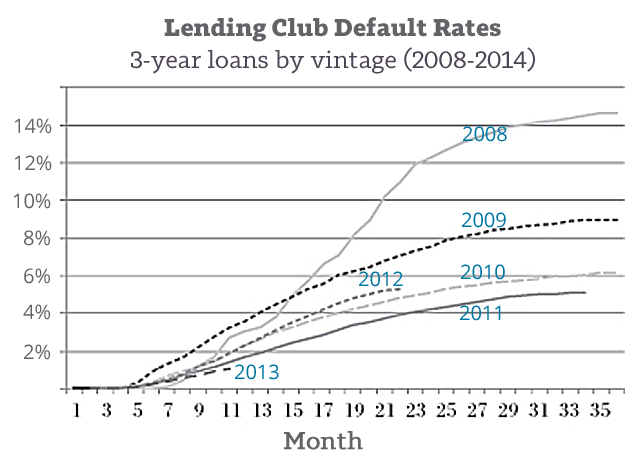

Furthermore, both Prosper and Lending Club have their historical loan data open to the public, so that we can remain confident that these loans remain high quality. In fact, their underwriting generally continues to improve year-by-year (see Lending Club’s below [source]).

#3. Investing at both Lending Club and Prosper involves risk

Investing at both Lending Club and Prosper involves taking on risk. People have lost money in this investment, and this is something every new investor needs to be aware of.

The main risk at both platforms is the loss of an investor’s money to defaulting loans.

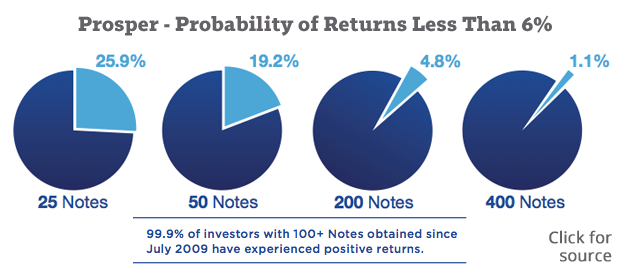

The main risk at both platforms is the loss of an investor’s money to defaulting loans, meaning borrowers who fail to pay their loans back. Every investor will experience defaulting loans eventually, but 99% of those who have a dramatically high default rate are those who simply failed to diversify their investment across enough loans.

In contrast, if we spread our investment across 200 loans or more, we begin to mirror the default rate of peer to peer lending as a whole, and minimize the chance we have an overall bad experience. In this way, the most common risk in peer to peer lending is largely within our own control.

That said, there are a number of very real risks that are beyond our control. For instance, if the national economy falls apart and people begin to lose their jobs, even prime-rated borrowers could be affected. In that case, our portfolio’s default rate could significantly rise. Additionally, we have no idea how our investment would perform if Prosper or Lending Club would go bankrupt, or if national interest rates rise and they no longer find investors for low-interest loans (read: The Complete Guide to P2P Lending Risks)

Peer to peer lending is a brand new investment; it’s less than 10 years old. As a result, we should remain aware of how these companies are developing (a good reason to subscribe to the LendingMemo newsletter). To boot, only a portion of someone’s overall invested dollars should be placed in p2p loans. This way we further minimize our overall risk and promote the chance that we have a pleasant and rewarding investment.

Lending Club vs. Prosper: 3 Ways They are Different

Even though both of these companies allow us to begin peer to peer lending, there are some very real differences between them:

#1. Lending Club has a better website

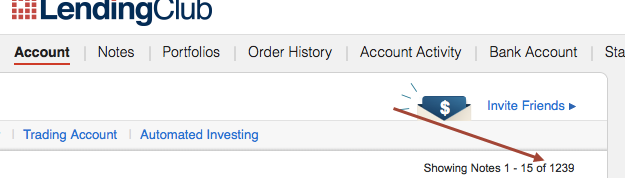

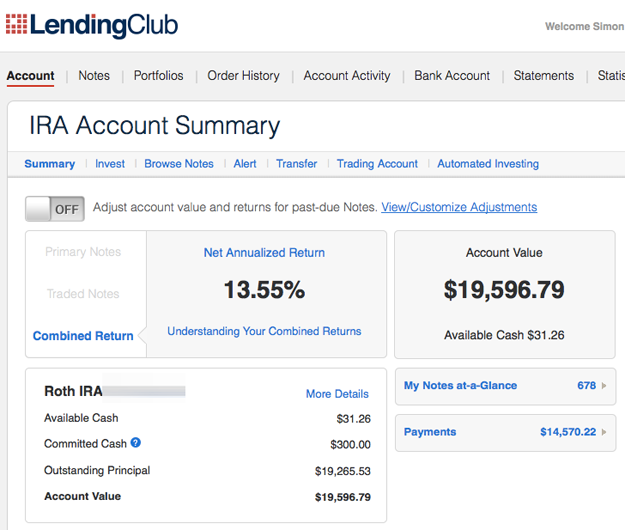

Most investors begin at Lending Club, and there is a reason for this. The biggest is, Lending Club’s website is just easier to understand. Its clean palette and tabs simply push investors in one direction: amassing a large quantity of notes. Things that complicate the investment, such as filtering, are a minimized aspect of their design. Here’s my Lending Club account:

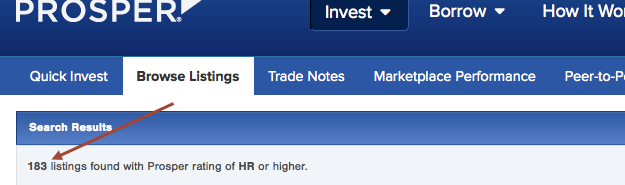

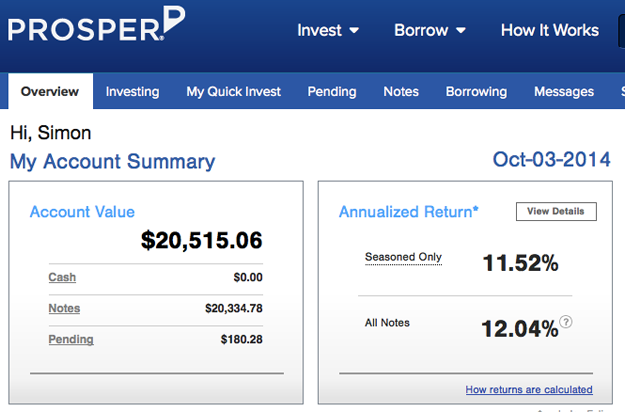

Prosper’s site is an equally good place to invest in peer to peer loans. I have used it for years with great success, but brand new investors may find it slightly more complex than necessary. Here’s my Prosper account:

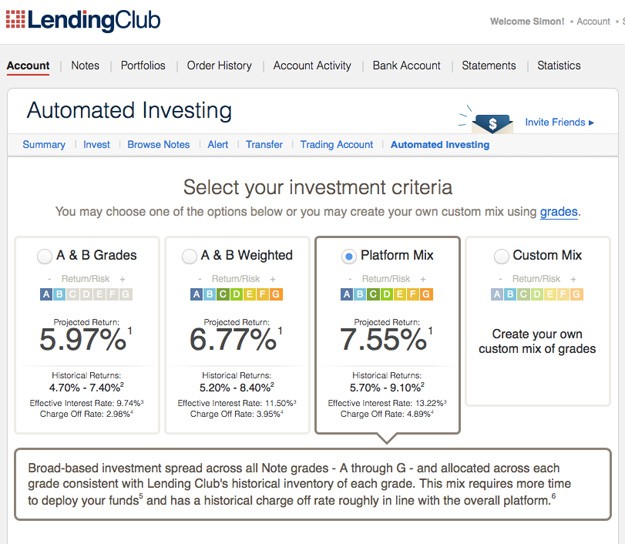

This issue can be easiest seen if we compare Lending Club and Prosper’s automated investing tools. While both platforms have ways for investors to automate the investing of available cash in additional loans, Lending Club’s Automated Investing tool is much easier for most people to understand (see below). You simply (1) choose the risk/grades you want and (2) choose the size of the notes you need, with most investors choosing $25 notes. Click one big blue button, and you’re all set. If you need to invest with a filter, you can do this as well.

Prosper’s Automated Quick Invest (AQI) allows for much better fine-tuned filtering than Lending Club’s. However, it suffers in the two areas that matter most: simplicity and loan volume. AQI is a bit complicated for beginner investors, and the tool can struggle to find fresh loans and put available cash to work.

Prosper has a goal to build out this functionality in the coming year, and when they do I am eager to update this article. Until then, Lending Club’s website remains the default place for most investors to begin.

#2. Lending Club has more loans

Aside from having a simpler website that makes peer to peer lending easier to understand, Lending Club also has a lot more loans to choose from than Prosper.

If I log on their website today, Prosper has about 180 loans for me to choose from.

In contrast, Lending Club currently has six times as many: over 1200 available loans. So if I were a brand new investor who wanted to put $5,000 to work in 200 loans @ $25 per note, I would have to log into Prosper a few times before everything was finished, and would generally need to place my investment in the A through C-grade loans that populate their platform.

Lending Club allows you to invest in 200 notes all at once.

Lending Club helpfully allows you to invest in 200 loans all at once, and you could even select a level of risk for this lump sum. For example, if I had the available cash, I could log into Lending Club right now and place $5,000 across 200 of the riskier D through G-grade loans. Simple.

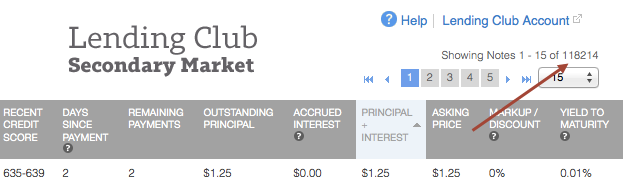

Lending Club even has more loans on their secondary market, seen in the Foliofn section of their site. This is both because they have thousands more small-dollar investors as well as the fact that they helpfully permit the sale of late loans, something Prosper does not allow. If I log into their secondary markets today, I see Lending Club has over 118,000 for sale. Prosper has about 5,000.

#3. Prosper has more loan variety

For all the praise that Lending Club receives, there are a few unique benefits that are only available to Prosper investors. The first of these is slightly better transparency. Prosper’s historical loan data is instantly available for prospective investors via a handy interface on their website, while Lending Club only releases theirs inside a denser CSV file download. Further, almost 30% of Lending Club’s loan data is hidden from the public (‘Policy 2’ loans, unavailable to retail investors like ourselves). In contrast, Prosper helpfully keeps everything public, so we have a more complete opinion on how successful they are as a company.

The main thing Prosper does really well is offer more loan variety, specifically, a broader credit spectrum to invest in. Not only do they provide investors with more credit variables for API and onsite filtering, but they have lower loan grades than Lending Club. I’m specifically speaking here of Prosper’s E and HR-grade loans.

As an investor on both platforms, Prosper has given me almost a full percent higher ROI (my returns), and I feel the main driver behind this success is the higher interest loans I can option for at their site. While Lending Club allows us to invest in borrowers with credit scores as low as 660, Prosper has credit scores as low as 640. For those able to take on the risk, those twenty FICO points may mean a slightly more lucrative investment.

That said, loans with interest rates of 27% and above at Prosper are quite scarce, so investors will probably need to invest with an API service like NSR Invest if they want to significantly invest in them.

Conclusion: Start with Lending Club

Because of their easier website and longer list of available loans, most investors will probably want to open their first account with Lending Club. Elements of their site, such as their simple and powerful Automated Investing tool, successfully make peer to peer lending an easy and rewarding experience for almost anybody who wants it.

In contrast, Prosper will appeal to people who want precisely filtered loans, technologists who value a better API, or those who want higher potential returns/risk. Also, if you live in Alaska, Michigan, Missouri, Oregon, or South Carolina, your state is closed to Lending Club, but open to Prosper (see state maps: here).

The benefits of having two underwriters

That said, any investor who is serious about this asset class should probably consider doing what I did, and open an account at both. By funneling your dollars through a variety of credit models, you will be more prepared to deal with any hiccups in loan quality that this industry is bound to experience at sometime or another. Invest through multiple underwriters; it just seems like common sense.

As seen in my accounts above, I have personally invested $20,000 at both Lending Club and Prosper, and have continued to experience consistent and rewarding returns from each. These are both great companies. While Lending Club’s site may be easier to use, things really do even out after enough time has passed. In the end, both give me what I need from them, which is a way to invest in the solid asset class of creditworthy Americans.

Why would Lending Club be unavailable in Alaska, Michigan, Missouri, Oregon, or South Carolina but Prosper is? Wouldn’t the same laws apply to both firms?

I assume Lending Club and Prosper would be available in all markets where they can legally operate. Maybe that assumption is wrong.

The same laws apply, but these laws have different interpretations, and either company needs to actually approach the states for approval. Its possible their coming IPO would mean Lending Club has less current incentive to seek individual state approval.

Great article. What does your net worth have to be in order to become an investor? Thank you.

Hi Kyle. It depends on the platform, and sometimes changes. I would check with customer support.

Awesome article, Simon – first in google results for lending club v prosper :)

I’ve been investing in LendingClub for a year, and everything is running smoothly.

On the other hand, I’ve just tried to invest with Prosper, but talking with their customer service reps on the phone really shook my confidence in the company. They were not good at answering my questions, whereas LendingClub phone reps seemed much more intelligent and courteous. I encourage all potential investors call both companies to hear the difference. Also check out the reviews for each company on CreditKarma.com

It seems to me that LendingClub has a much brighter future.

Another interesting point learned when talking to an LC phone rep — you can do Automated Investing and have any amount of “cash reserve” that is fully liquid. And that cash reserve is FDIC-insured. To set one up go to Automated Investing > Edit Allocation > and set your allocations such that the total is less than 100% (whatever remaining percent you want as cash reserve.) If this is confusing talk w/ their reps about how to set it up.

Thanks George. Sounds like you’re on your way. Note: I’m pretty sure Lending Club cash balance is not FDIC insured.

Gratefully, the cash balance in both Lending Club and Prosper are FDIC insured on a “pass through” basis, through Wells Fargo:

Lending Club FDIC:

http://kb.lendingclub.com/investor/articles/Investor/Is-my-money-insured-through-the-FDIC/?l=en_US&fs=RelatedArticle

Prosper FDIC:

http://blog.prosper.com/2008/10/06/your-cash-balances-are-fdic-insured/

and https://www.prosper.com/help/investing/

So great! I was unaware of this.

i am investing in Lending Club. what I am wondering is, if Lending Club or Prosper going to go under will we the investors will be paid on our loans?

Hi Stan. Both the companies have backup servicers in place in the event of a bankruptcy. That said, there are no guarantees, so this is definitely a risk to consider.

Simon, I am just curious how your IRA could be linked to LendingClub. I got the overall concept though and sounds like a great way to invest.

Hi Ishan. Lending Club actually does this themselves (through a 3rd-party IRA custodian). Just call up Lending Club and they can walk you through the signup process.

Just stumbled on to this and I’m very interested. Can I use some of my 457 and invest in LC? I’m still currently employed and I don’t know if I can use some of my 457 to invest in LC.

Generally, 457 plans are similar to 401K plans in a sense that your investment options are limited to preselected investment categories of risk. I’m assuming you are with a government agency since you have a 457 plan. Your HR department should be able to clarify everything for you!

I have a Lending Club account for just a few months now. I was thinking of adding a Prosper account but their fees seem much steeper. Prosper charges investors 1% of the account balance every year. Lending Club doesn’t charge a yearly fee but charges a 1% fee on the borrowers payment (pennies)

Seems like if I invested $10,000 in each account, I would pay Prosper a lot more in fees. Am I missing something ? Thanks

What is the minimum duration i need to keep the cash invested?

If i need money back after i invested how quickly can i get to my bank account without any penalties ? Anybody can throw some light on exit strategy?

Great article.

I’ve been investing in Prosper.com since April 2013. I currently have about 190 loans and my overall yield is almost 7% since I started. I’ve changed my strategy a bit and this year I’m well over 9%, hoping that will continue.

I have not looked at Lending.com, but am going to soon.

Prosper website is glitchy and when a company is dealing in money as they are, their website should have minimal glitches.

I’ve written to them about this and often its the same issue repeatedly and if they respond at all I’m lucky. There answer is typically just pap and dribble. Nothing of significance and nothing remotely sounding like they are disappointed that we are having trouble.

The website is usually very slow and today I can’t sign on at all on Chrome or Microsoft Edge browsers. It times out every time.

I like to pick my loans myself and I love the many criteria I can sort through to decide which I like best. That is the best thing about it for me.

Just wanted to say that if Lending.com website is better, I may begin to switch over as my loans at Prosper dwindle.

One big un-noted difference: Prosper’s interest earnings are much more accessible than Lending Club’s. Prosper provides investors the option of setting aside interest earnings for withdrawal or reinvestment; Lending Club reinvests/capitalizes all earned interest, with liquidation being possible only through establishment of a note trading account. The latter requires a fair degree of sophistication and time to properly price, and the volume of notes for sale is daunting.

I shopped from both for $28000. Prosper gave me 10.28% and Lending club gave me 9.99%.

Why aren’t the servicing at platform fees correctly treated as grossed up and deductible only under Section 212 of the Internal Revenue Code?

I am thinking of selling my business and will owe the government around $50k at tax time. Since I have a few months until Uncle Sam comes calling, can I invest that money short term with Lending Club or Prosper or is there a set time period you must stay invested?

Lending Club or Prosper are not short term investments.