Much has been said on sites like this one about peer to peer lending’s inherent value for the everyday American investor, particularly its great returns and social benefits. That said, the average person has yet to discover it. Lending Club’s potential IPO may help in this regard, but on the whole, peer to peer lending is still an alternative to the typical avenues that our country uses to put its excess cash to work.

This is changing. Peer to peer lending seems like it is being mentioned in major press with greater frequency each year, yet there has never been a study that showed the rise in this rate numerically.

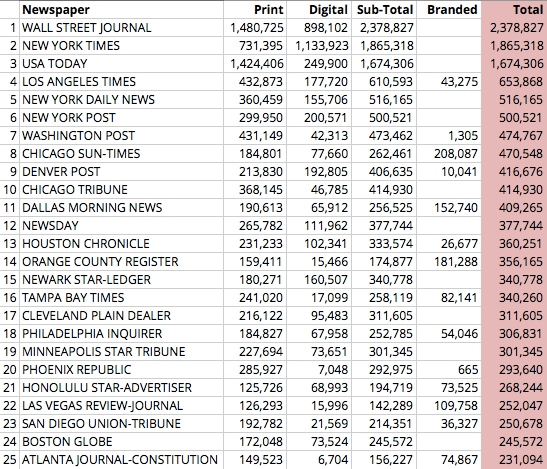

A quick Google query revealed a report by the Alliance for Audited Media (AAM), a non-profit organization that has tracked the circulation of major newspapers throughout the United States. Below you can see their ranking of the largest 25 (source):

The total circulation of these newspapers is over 14 million. If peer to peer lending is gradually being introduced to average Americans, the evidence would be seen in a growing volume of mentions within this circulation.

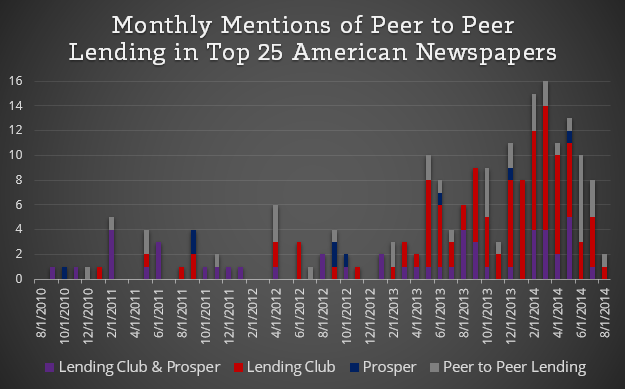

Monthly Mentions of Peer to Peer Lending in American Newspapers

To explore this growth, I cataloged every mention of Lending Club, Prosper, or peer to peer lending on the websites of these newspapers for the past four years. This resulted in a list of exactly 200 mentions. Then I noted whether the articles mentioned Lending Club or Prosper (together or on their own), as well if neither was mentioned at all. Arranging these articles by month, I came up with the following chart:

Some items of interest:

- The skew of the data definitely reveals that the public is being introduced to peer to peer lending with greater frequency. Four years ago, it received an average 1.8 mentions/month, versus an average of 9.9 mentions/month in the past year.

- Lending Club alone is receiving the majority of these mentions.

- Newspapers frequently mention Lending Club and Prosper in the same article.

- The bump outside the curve (May 2013) is the month when Lending Club got press for both its possible IPO and its investment from Google.

- There has been growth in peer to peer lending being spoken of in the press without a mention of Lending Club or Prosper. This reveals growing interest in peer to peer lending overseas (China, UK, etc) and increased coverage of companies that identify as peer to peer finance, like Funding Circle’s recent coverage in the New York Times.

P2P Stories: The Cream of the Crop

Here are three of the best in-depth articles from the past four years:

- Loans that avoid banks? Maybe not. New York Times: May 5, 2014

- Wall Street Joins the Peer to Peer Loan Party Washington Post: Sept 6, 2013

- Consumers Find Investors Eager To Make ‘Peer-to-Peer’ Loans The Wall Street Journal: Aug 6, 2013

Plus this great piece on a distillery that opened with a peer to peer loan:

- Florida distillery launches premium artisan vodka made of cane sugar Tampa Bay Times: Nov 22, 2012

Final Word: Up and to the Right

If you look at the pages devoted to press coverage at Lending Club and Prosper, they are filled with a variety of great mentions highlighting this new way to borrow and invest. That said, the majority of these “In the News” references are financial sites. It might be an interesting follow-up to this post to explore peer to peer lending’s frequency in financial media. I bet the numbers would be greater and the curve more pronounced.

That said, my hope is for p2p lending to end up in more popular media like our nation’s newspapers, making it part of the way our country lives its life. In that regard, things seem to be off to a great start.

[image credit: Phil Roeder “Morning Paper” CC-BY 2.0]

Nice analysis Simon! 1.8 to 9.9 equals about 450% growth over 4 years. If you haven’t done so already, you should check out Google Trends for the same keywords. You will probably see the same effect.

Thanks Jason. Honestly, it was fun data to compile. I got to discover a ton of articles I had no idea were out there.

One side critique that is worth mentioning is how the best pieces were from NYT, WaPo, and WSJ. I really wish the other 22 American newspapers would get interested and do their own in-depth pieces on p2p lending.

Hi Simon,

I value your opinion on p2p very much. You are certainly the “guru” in your field.

Do you think that Funding Circle will be the next p2p Lender next to Lending Club and Prosper? I know that there are already big in the UK.

I realize they do mostly business loans, but if there would do mortgages before Lending Club are doing them ( I know its one of there future goals) they could get really big.

Just my 2 cents.