Part 1 – What is filtering?

Part 2 – Creating a simple filter with NSR

Part 3 – Filtering at Lending Club

Part 4 – Filtering at Prosper

When I began investing in 2011, one of the most confusing parts of peer to peer lending was choosing which loans to invest in. After all, hundreds of loans were available to invest in. Which were the best ones? Or were all the loans the same?

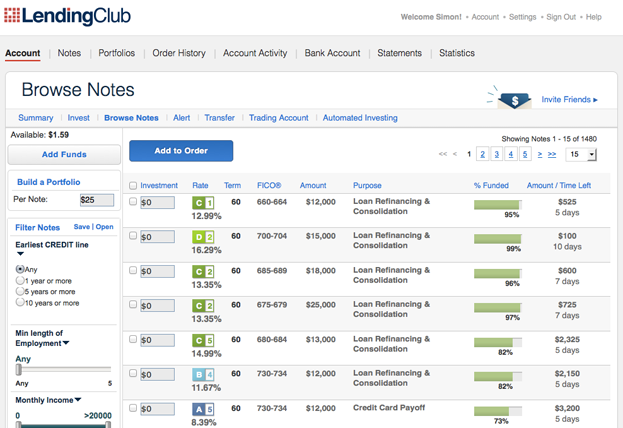

Lending Club’s list of available loans

I noticed Lending Club and Prosper allowed their list of available loans to be sorted and filtered by different attributes, like whether or not a borrower had a past bankruptcy. But there was little advice about how to use this data, like which attributes were the best ones to sort with. Eventually I figured things out, but it took a fair amount of time and research.

Many investors feel their returns have been significantly increased with filtering.

What I discovered is that filtering is probably the most complicated part of peer to peer lending, and that it is not necessary to have a rewarding lending experience. Thousands of investors earn great returns without confusing themselves around this issue. That said, many investors (including myself) feel their returns have been significantly increased with filtering. So for those with the time or interest, filtering remains a great option to explore.

My goal for this article is to define p2p filtering in full. This way, you can choose whether or not to do it yourself, and how deep into it you personally wish to go. With time, you may discover (like I did) that filtering loans is one of the most fascinating parts of peer to peer lending.

Let’s get started.

What is Filtering in Peer to Peer Lending?

To introduce filtering, it’s best to remember that Lending Club and Prosper deny 90% of the people who apply for a loan through them. This is because 90% of loan applicants fail Lending Club or Prosper’s underwriting (or minimum credit standards). Most people who need a loan have poor credit history, have little income, or carry too much debt to be a safe investment.

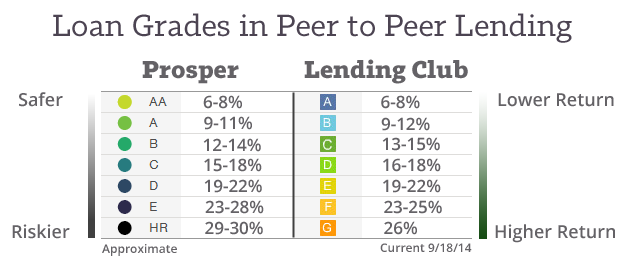

That said, 10% of the loan applications do get approved. And upon approval, both Lending Club and Prosper give each loan a grade (or rating) and interest rate indicating how safe it is as an investment. When a loan gets an interest rate, in industry speak it is ‘priced’. Lending Club’s loan grades go from A to G, with As being the safest and Gs being the riskiest. Prosper’s grades go from AA (safest) to HR (high risk).

Borrowers who have great income and perfect credit history are more likely to get assigned an A-grade loan, and borrowers with low credit scores and poor employment are likely to get closer to a G-grade loan (if they get approved at all). Because of the higher interest rates, investors like myself have typically earned a much better return by investing in the riskier D-G grade loans.

Anyways, both Lending Club and Prosper are incredibly skilled at accurately assigning each loan with the correct grade. E-graded loans almost always perform how E-grade loans have performed in the past, that being, they default more than A-D graded loans but do not default as much as F-G graded loans.

That is why filtering is optional. Most loans perform exactly as advertised, so investors can earn great returns either way.

The Loan Grades Are Not Completely Accurate

But here’s the thing: the loan grades are not perfect. Despite Lending Club and Prosper’s best efforts to make all loans within a grade the same, there remains a degree of variability in these loan assignments. Some B-grade loans are better than average; some perform worse.

Filtering is a kind of financial arbitrage.

This is when filtering comes into play. Filtering in peer to peer lending is choosing the loans that have historically performed better than others, even if they were the exact same loan grade. Filtering is a kind of financial arbitrage. It means we exploit (for lack of a better word) the weak spots in Lending Club or Prosper’s loan grade assignments so as to achieve higher than average returns.

We are able to do this because all of the loan data is freely available to the public. As a result, we can look at all the credit attributes of past borrowers to find certain ones that historically performed better than others. Once we figure out a few credit criteria, we can then filter the available loans on Prosper.com or LendingClub.com for those that match this criteria. Remember, nothing is guaranteed here, but our hope is that these new loans will perform similarly and give us higher than average returns.

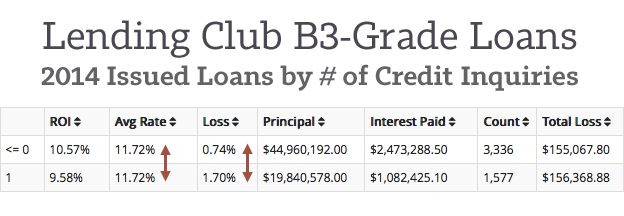

Exhibit A: Inquiries in the past 6 months

Here’s an example. One of the credit variables of borrowers at Lending Club and Prosper is ‘Inquiries in the past 6 months’. This is the number of hard inquiries (or ‘hard pulls’) that a borrower has on their credit history. Typically, borrowers with more credit inquiries are slightly riskier investments, because it means they may have been shopping around for a loan and will be less stable in their repayments.

That said, the thing we want to pay attention to here is not whether credit inquiries are “good” or “bad”, but how this credit criteria has performed in peer to peer lending over the past few years. And if we look at the numbers, we see that loans with the exact same loan grade have performed differently when sorted by credit inquiries.

B3 loans with zero inquiries have the exact same interest rate as those with one inquiry, but have 1% higher returns. What does this mean?

It means that, despite Lending Club’s intention to make loans of the same grade behave the same, they struggle to accurately assign loan grades around the criteria of ‘Credit inquiries in the past 6 months’. As a result, we filter using this credit variable (and other variables like it) to increase our returns above average.

Personally, I continue to earn around 10% per year at Lending Club and Prosper, and feel filtering is a big reason for my success.

Filtering in a Nutshell

This is the essence of filtering peer to peer loans. We filter by (1) examining the historical loan data for credit variables that perform above average, and (2) invest in notes that match that criteria.

Furthermore, we don’t even have to do all the grunt work of compiling all the historical loan data ourselves. Generous investors like Michael Philips of the site NickelSteamroller (NSR) have already done this and have released this data to the public. So we can simply navigate over to NSR and explore the data ourselves.

Furthermore, we don’t even have to do all the grunt work of compiling all the historical loan data ourselves. Generous investors like Michael Philips of the site NickelSteamroller (NSR) have already done this and have released this data to the public. So we can simply navigate over to NSR and explore the data ourselves.

Of course, if you lack the time or interest to do any of this yourself, you can always use the filters that other investors have made public. Read: My Personal Filters for Lending Club & Prosper

In part 2 of our filtering series, we will create a filter using the NickelSteamroller backtesting tool. In part 3, we will show how to invest with these variables on the Lending Club website. In part 4 we’ll filter at Prosper.

[image credit: ‘Cooking‘ by Chris Marchant CC-BY 2.0]

Leave a question or comment