One of the main concerns people have in this investment is its average default rate, which means, the rate at which people fail to pay back these loans. This is a really valid issue considering the investor takes the full brunt of the loss when a borrower defaults. Risks like a platform bankruptcy or new regulatory burdens are important to keep in mind, but nothing has a more direct and negative impact upon our investment’s overall return than the rate at which our borrowers default on their loans.

So people often rightly ask: “What is the default rate at Lending Club or Prosper?” Today we will answer that question in full, starting with a look at Lending Club’s historical loan performance, and finishing with a look at Prosper as well.

Historical Default Rates at Lending Club

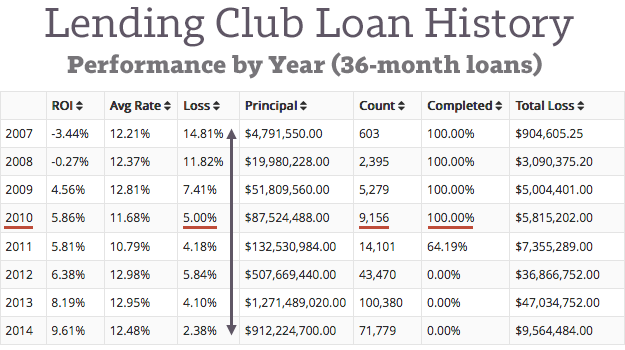

Instead of trying to calculate the default rate ourselves, the always-helpful statistics site NickelSteamroller (NSR) has actually done all the heavy lifting for us. If we visit NSR’s Lending Club backtester tool and simply click the blue filter button, we can scroll down and see Lending Club’s loss rate (default rate) by year (indicated by the vertical arrow):

As you can see, the default rate they calculate (methodology) has actually changed a lot over Lending Club’s eight years of operation. Taking a macro view of this performance, there are some projections we can make about where the default rate is today and how it has changed over time.

Lending Club’s current default rate: about 5%

For 2010, you can see I’ve underlined a few key items. The first thing to notice is the fact that 100% of 2010’s 3-year loans have completed, having either defaulted or been paid back — over nine thousand loans in all. And the loss rate for this set of loans is 5%.

In short, the default rate for Lending Club’s most recent year of completed loans is 5%, and I feel this figure is a reasonable expectation going forward, as I’ll demonstrate in the following paragraphs.

We can ignore default rates for 2007 through 2008

Some might highlight the default rates for 2007/08, citing these as an indication for how reckless this investment is. However, just 600 loans were issued in 2007, not even enough to be statistically significant. Furthermore, Lending Club’s 2,400 loans in 2008 were issued under the company’s earliest credit model, and happened during the greatest economic downturn since the Great Depression – not really representative of how things usually are nationwide.

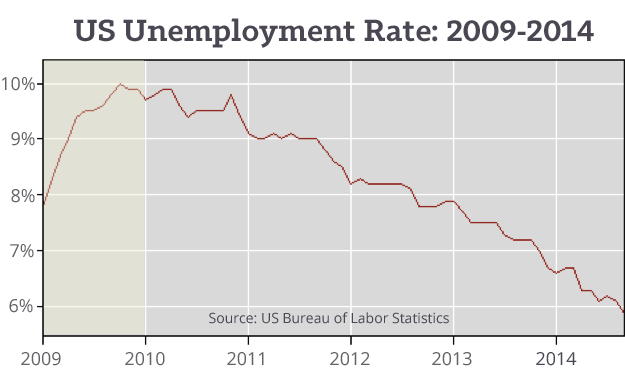

A fairer critique of default rates being 5% might be the 7.4% loss rate of 2009. However, the main economic factor that impacts peer to peer loan repayment rates is the national unemployment rate, and as you can see in the chart below, the Great Recession actually caused unemployment to peak in 2009, not 2008, which jives with studies showing the recession was not finished until mid 2009 (NBER.org).

This goes to show that Lending Club’s 2010 loans, with a default rate of 5%, are the first completed year we have of peer to peer lending loss rates during a somewhat normal US economic cycle.

Lending Club’s Default Rate Since 2010

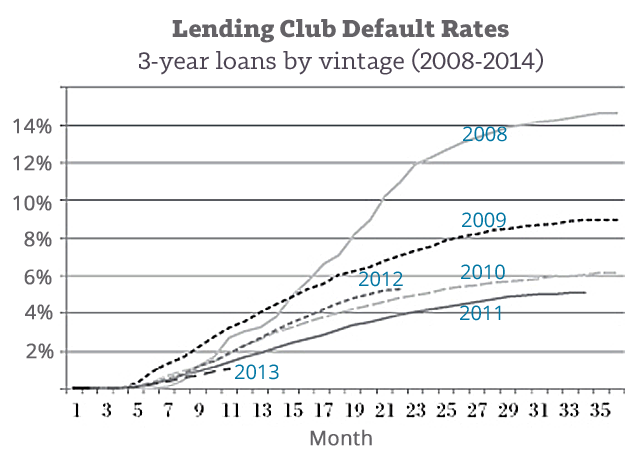

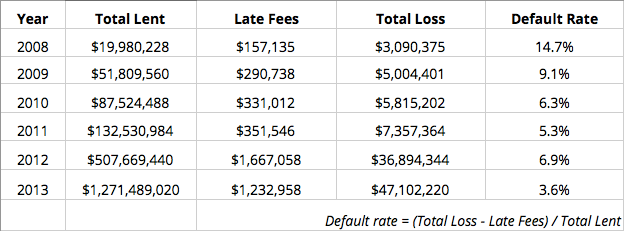

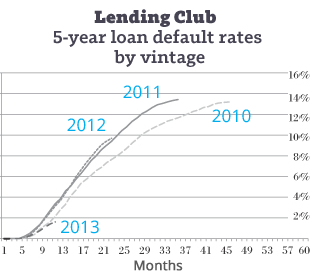

But just because Lending Club managed a 5% default rate for a single year is no guarantee they will perform similarly in the future. That said, I think we can demonstrate future years acting similarly if we look at performance since then, and a good place to do that is by examining the chart below (included in Lending Club’s recent S-1 filing with the SEC). Even though 2007-2010 are the only completed years we have, this chart reveals the cumulative loss rates for years that have yet to complete:

[Note: Maybe you’ve noticed the default rates on this chart being higher than the data from NSR. For those interested, the chart in the SEC filing is more focused on simply highlighting Lending Club’s underwriting quality, so it finds the default rate by taking total lost principal, removing late fee earnings, and dividing this by the total issued principal (hat tip to Michael @ NSR for figuring this out).]

Like calculating returns, there are many ways to do the math.

The point in showing the SEC-filed chart of vintage curves is to compare the default rate of 2010’s completed year to the remaining loan vintages that have yet to complete. And as we can see in the graph above, the default rate for 2011 actually improved over 2010, and will likely finalize around 4.5%.

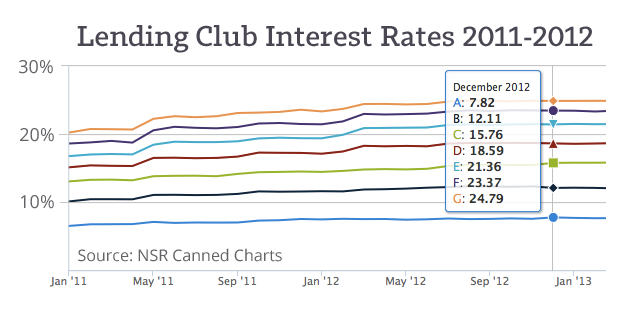

In 2012, Lending Club Moved to 700-FICO Borrowers

From here we would expect default rates of 2012, 2013, & 2014 to slowly improve year by year as the economic woes of 2008 fall farther and farther behind. But they don’t. In 2012, the management at Lending Club made a change that would impact their default rate for the years going forward: they lowered their average borrower FICO score and increased their average interest rate. In 2011 the average borrower at Lending Club had a FICO of 716 and received an average interest rate of 10.8%. In contrast, borrowers in 2012 had an average FICO of 703 and received an interest rate of 12.98%, over a 2% increase. See the change in this chart at NSR:

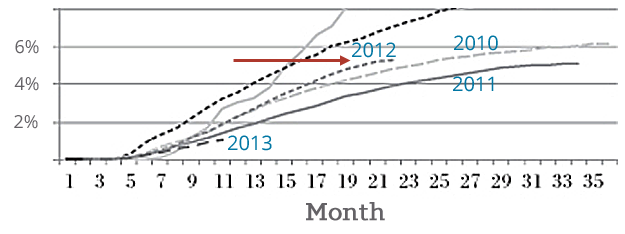

This slight notch down the credit spectrum resulted in a new default trend, causing 2012’s rate to actually curve above the previous two years:

I actually think decreasing the average FICO and increasing interest rates was a brilliant move on Lending Club’s part. I think they saw the economic situation improving from 2008, and realized they had an opportunity to (1) match the tolerable default rate of 2010 while (2) actually increasing the average yield for their investors. I think they saw the chance to further solidify their investor base, and they took it.

Lending Club Default Rates Today? Still About 5%

Just like 2012, the average FICO score in late 2014 remains around 700, at least for their public data. Furthermore, as seen in the 2013 curve above, Lending Club’s default rate continues to get better, perhaps a combination of improved underwriting and a consistently lower unemployment rate. It looks like the 5.8% default rate of 2012 will be improved upon year-over-year, perhaps landing near 5% for loans issued in 2013.

Since 2012, the past three years have seen over 200,000 loans issued with an average interest rate of around 13%. Minus this 5% default rate and 1% in fees, this estimates most investors experiencing an average return of 7% on a seasoned portfolio (13-6=7), an estimate placed right in the middle of the 5-9% expected investor return cited by Lending Club over the years.

Default Rates at Prosper Marketplace

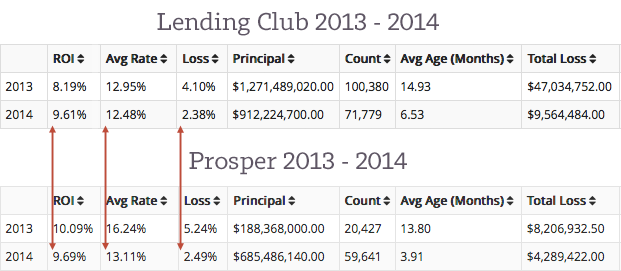

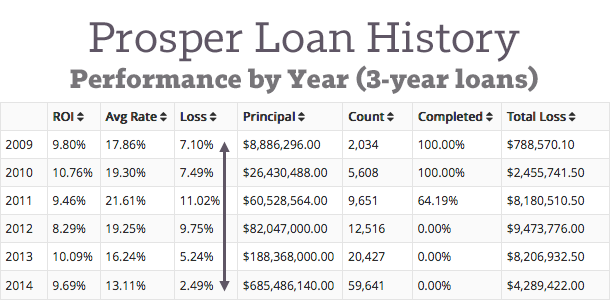

How about Prosper Marketplace? This is a lot trickier since Prosper has changed their average borrower a few different times since the company’s inception. Here is a breakdown of their default rate by year:

Unfortunately, this data is not really that helpful in talking about where Prosper is today. Similar to Lending Club, their most recent completed year is 2010. However, the loans they were issuing back then were a far different animal than those they are issuing today: 2010 loans with 19% interest rates vs. 2014 loans with 13% interest rates.

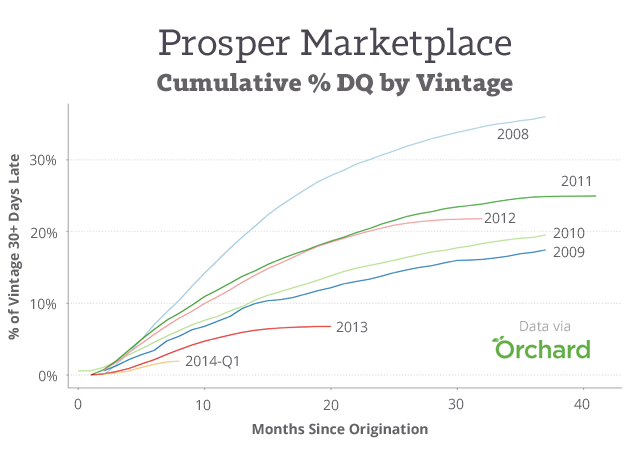

Orchard Platform showed this distinction within Prosper’s different years in their recent savvy post showing the cumulative delinquency rate by vintage:

Again, we see here that Prosper’s 2013 and 2014 vintages are looking dramatically different than their previous years. As a result, we’re going to have to look somewhere else to guess their default rate.

Prosper changed tack in 2013, likely new default rate is 5%.

That “somewhere else” is Lending Club. Here is the 2013 and 2014 data for 3-year loans at Lending Club and Prosper side-by-side (further courtesy of NSR):

Prosper changed their approach to match that of Lending Club; they currently issue loans to borrowers with an average FICO of 700 as well (Lend Academy). And their average interest and default rates for 2014 almost exactly match up, with a current ROI that is 8-hundredths of a percent apart.

As a result, I would wager that Prosper’s current issued loans will have an almost similar default rate as the one projected for Lending Club: 5%.

What About 5-Year Loans? An Exercise in Speculation

Lending Club issued its first 5-year loan on May 14, 2010 to somebody in Portland (loan #516401). We are still seven months from the first batch of these 5-year loans completing, and many of us in the peer to peer lending world are awaiting these final results with baited breath.

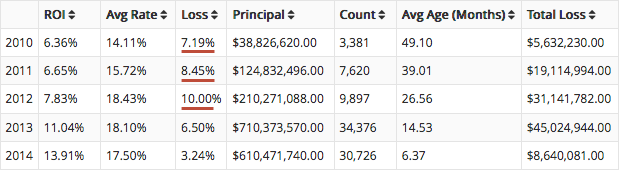

Until then, we can only guess the default rate using the data that is currently available to us. Here is the breakdown of 5-year loans by vintage from NSR:

I’ve highlighted the default rates for 2010-2012 because I feel these tell a similar story as the 3-year loans. You can see Lending Club issued an average interest rate in 2010 of 14%. But in 2011 they lowered their FICO standard to 700 and increased interest rates, bringing them up to the 18% figure that they’re at today. Considering the curve for these 2010 loans is fully seasoned (see SEC data on the right [different loss rates]), I assume the default rate will only go up a point or so in the coming year. So it’s possible these early 5-year loans will have a default rate of around 8%.

I’ve highlighted the default rates for 2010-2012 because I feel these tell a similar story as the 3-year loans. You can see Lending Club issued an average interest rate in 2010 of 14%. But in 2011 they lowered their FICO standard to 700 and increased interest rates, bringing them up to the 18% figure that they’re at today. Considering the curve for these 2010 loans is fully seasoned (see SEC data on the right [different loss rates]), I assume the default rate will only go up a point or so in the coming year. So it’s possible these early 5-year loans will have a default rate of around 8%.

However, the 2012 vintage are riskier loans than 2010 (interest rates 18% vs 14%), so they are going to have to climb a steeper hill. As a result, I would not be surprised if these 5-year loans cross a default rate of 10-11% by the time they complete. That said, I think the 2012 5-year vintage will likely possess a higher default rate than those that follow, as Lending Club’s borrower standards for 5-year loans (and likely their underwriting as well) have improved in the past two years, all within a more favorable national employment climate.

It might very well be normal in peer to peer lending that, in five years time, 36-month personal loans will be known for 5% default rates, and 60-month personal loans will be known for 10% default rates.

These Default Rates Tell a Remarkable Story

In the end, what I love about all these charts is how they show this new investment evolving year by year. If there’s anyone who pays closer attention to default rates than investors, it is the teams who manage these platforms.

Indeed, the default rate data shows Lending Club’s management obviously grappling with the ugliness of the Great Recession around the time their company began. We have them positively recovering from this drama in 2010, and then intentionally pivoting, increasing investor yields in 2011. Finally, we have them discovering how well this works in 2012, this recipe of FICO/interest-rate keeping them the industry leader that they are today, issuing $1B in loans per quarter, on track for a successful IPO in 2014.

The data also gives Prosper’s story: their different approaches to borrower standards over the past five years, their average interest rate in all sorts of places. We have the new management team in 2013 coming to terms with the fact that Lending Club’s 700-FICO 13%-rate loan is likely the best way to thrive in this industry, a tack that has obviously worked very well for them. They have already issued 3X the 3-year loans in 2014 than they did in all of 2013.

Over everything, I see an industry doing its best to figure out this beautiful new thing called peer to peer lending. I see refined underwriting algorithms and mailed borrower marketing, encouraged investor capital and purpose-built technology all repositioning itself over and over for the past eight years until they arrive at the stable place they hold today. I see analysis and sweat and reanalysis in these charts, and in the end I see it culminating into one of the most simple and creative investments our country has ever seen.

[image credit: Richard Taylor “Sunken boat at sunset” CC-BY 2.0]

Simon, really great read here, and I’m glad you’ve dug into this topic. Peer to peer lending is not always pretty, and the defaults can tell an incredible story of how the industry is maturing. You can see how both companies have worked to ‘get it right’ by improving their credit modeling to reduce defaults and appeal to borrowers by offering an interest rate that best matches their risk.

Of course, the grain of salt must be applied given the overall economic prosperity over the last 5 years since the downturn in 2008-09. It would be interesting to see the curves after another extended downturn to see how well things would hold up in that environment. I believe well diversified investors would still enjoy positive returns, but those who aren’t would likely suffer losses.

Thanks Adam. Very much agree about seeing how this industry shapes up with time. I would never state that a 5% default rate is guaranteed going forward, just that it seems a likely expectation in a regular year. In an economic downturn it is unlikely this rate will hold so steady.

There’s this interesting lag-time between the economic condition and the eventual default rate that makes things take a while to pan out, so it’s sort of interesting that, say we had a big downturn in 2015, the default rates might actually go down before they go up considering the data would still be representing the bull market low-unemployment environment of 2014.

Excellent job on the research and presentation. Really enjoyed the article and the perspective it puts this investment returns in (ie. still very positive but you need to have the right perspective going in).

Thanks LM

You are reading the data you link to wrongly. The 5% loss rate for 2010 completed loans you refered at as its “default rate”. This is a loss rate, not a default rate. The default rate is much higher than 5%, because loans that default after some principal and interest have been repaid incur in a loss lower than the total amount funded of course.

To have a loss of 5% you need a default rate at the very least in the neighborhood of 7-8%.

Hi Lucio. Thanks for your solid critique.

In peer to peer lending, the only way losses are realized is through defaults, so they’re actually synonyms. What you’re getting at, and what I could have described better in the article, is the default rate of the vintage annualized vs. as a whole. Or am I missing a credit industry terminology best-practice here?

That said, I did state the vintage loss rate, just not as clearly I could have because it wasn’t the point I was trying to make. If you see the default rates Lending Club filed with the SEC, I did clearly state the vintage as a whole suffered 6.3% for 2010, yet the annualized default rate (the point of this piece) was still 5% as stated in the opening section. As investors, we are primarily concerned about annualized default rates.

Hi

Great article.

All thing being equal, does highler FICO score results in lower default rate.

Thank you

Yes. FICO is a measure of a person’s creditworthiness. So better credit is correlated with a lower default rate.

Out of curiosity after reading this article, I applied for a lending club loan to see if I would be prequalified. My credit score is 748 and Lending club prequalified me for a 20k loan, 3 year term at 19.9% and 12 month term at 13%…wow. There appears to be more than credit score at work here.

Definitely. Hundreds of variables combine to create your designated interest rate.

I don’t think that higher rates of default during times of high unemployment should be brushed off so quickly. They indicate that there is a correlation between the loans and the stock market, making them a less attractive investment for those already holding stocks. In financial lingo, the R^2 is sizeable.

Actually Nightvid, there is very little correlation with peer to peer lending and stocks. Read this: https://www.lendingmemo.com/p2p-lending-uncorrelated-asset-class/

I’ve been with LC since 2009 and I’m finally throwing in the towel. My automatic investing portfolio is NAR 5%, and my hand picked is 7% (seasoned notes only). It’s not worth the effort for those numbers. My money is better used elsewhere.

thank you simon for this information. it was exactly what i was looking for.

i’m from pennsylvania and i don’t think we are allowed to ‘lend’ money through

lending club or other such sites because of political donations and bribery by the banks in my humble opinion.. so i invested in (lc) lending club stock

instead. there will be many tweaks and changes in this new business model moving forward. but as the CEO of lending club said, lending club has to keep their defaults down and provide a good return for investors or the investors simply won’t be there.

Question that I don’t see answered by this article or other articles I have read.

If higher risks loans have a higher default rate but a higher rate of return, why not only invest in higher risk loans? It seem to reason that even if more default, you are earning a much higher rate of return on the loans that have not defaulted and thus would earn higher rates of return overall. Or is it a wash? Thanks.

Because lower return notes are much more stable over time. See here: https://www.lendingmemo.com/p2p-lending-recession-performance/

Regarding my 1st experience in applying for a loan from Prosper, I was requested to provide my Bank account login user ID & PASSWORD. I was not receptive to that idea, thinking it would put my account in a very vulnerable position & not very wise. However, in review of your own experience with said company, I did note that you did provide such info to expedite your loan. HOWEVER, I did not see reports of you dealing with a money gram to return miniscule amounts deposited into your account by Prosper to Prosper, which is what was requested of me, to do, in order to move forward with my application. Is this an exception or a red flag that something is not kosher in my circumstance. Appreciate any input that will provide clarity as to what is/is not reasonable request(s) so as to facilitate a loan with Prosper.

Hi Doris. Do you mean the verification deposits into your bank account?