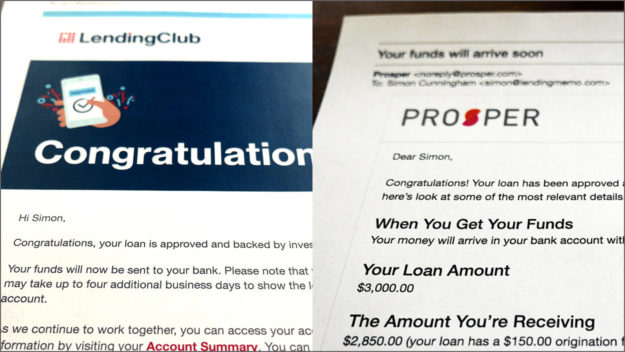

Lending Club and Prosper are two options for getting an online loan. But which is better for you? As seen in the picture above, I personally took out loans from both companies, and in this article I will explore Lending Club vs. Prosper. First I will show how they are the same and then I will show how they are different.

3 ways Lending Club and Prosper are the same

#1. Both offer great personal loans up to $40,000

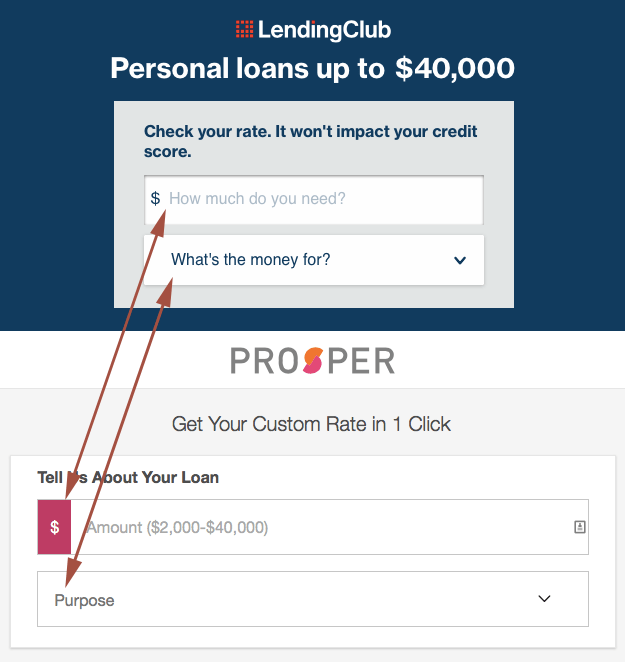

The truth is that both companies offer the same basic thing: personal loans up to $40,000. Both companies run completely through the internet, so both companies often have lower interest rates than physical banks like Chase Bank or Bank of America. Both offer the option to check your interest rate risk-free to see if you qualify for a loan. Even the loan application for both companies is similar:

If you accept their loan offer, both companies charge you a fee that comes out of the lump sum they deposit in your bank account. Usually this fee is around 5%, though it can be less for those with excellent credit. Example: if you take out a $3,000 loan through either of them, the actual amount they send you might be closer to $2850, a fee of $150 (5% of $3000).

Both Lending Club and Prosper automatically take monthly payments out of your bank account until the loan is paid back. All in all, the process is very much the same at both companies.

#2. Both examine your credit history and how much money you make

Your yearly salary and credit score are the two main things that these companies look at when approving your loan and giving you an interest rate. There are other factors they consider as well, such as if you rent or own your home, but income and credit history are the big two.

As a result, here are two things you can do to get approved at the best possible interest rate:

- Improve your credit score. Don’t just assume your credit report is accurately representing you. Actually look at it and make sure it is free from errors, or that you are up to date on your bills. (Note: checking your credit history at AnnualCreditReport.com is free and won’t hurt your credit score.) Many borrowers have been denied for a loan because their credit report says they are late on a loan that has actually been paid back. In situations like that, people need to call the creditor and have them fix this mistake. Afterward (boom!) the person’s credit score goes up.

- Report all of your income. Both Lending Club and Prosper offer you the opportunity to report additional income you earn besides the salary you get at your 9-5 job. If you have a side job that earns an extra $2000, make sure to include that information. Before you leave the “Additional income” box blank on your loan application, pause and ask yourself, “What sources of income come into my bank account that I might have forgotten?” Higher income will give you a better chance at getting your loan approved, and at a lower rate.

#3. A loan from either company can make your life worse (it’s true!)

The truth is, taking out a loan is risky. It is much safer to live debt-free! Every year many people take out a loan only to get sucked into spiraling cycles of debt, using (for example) a new credit card to pay off the old credit card. Taking out a loan is a decision full of risk.

Ask yourself: will I use my new credit line responsibly?

As a result, only take out a loan from these companies if you actually need it. For example, if you need a loan to complete some home improvements and you have the income to make the loan’s monthly payments, then perhaps getting a Lending Club or Prosper loan is a good decision. However, if you are getting the loan to pay off credit card debt, but you know (if you’re honest with yourself) that in the past you have not had the discipline to keep your credit card paid off, then you should seriously question taking out another line of credit. Perhaps you are someone who just cannot help but charge their credit card with purchases you cannot afford, like $200 nights at the bar or $10,000 vacations.

Before applying for a loan from Lending Club or Prosper, ask yourself this question: will I use my new credit line responsibly? If not, the loan may only serve to increase your monthly interest payments, not decrease them. The loan could very well make your life worse, not better.

Five ways that Lending Club and Prosper are different

#1. Each company will probably offer you a different interest rate

Before accepting the loan that Lending Club offers you, also check with Prosper. Loans on both websites are pretty much the same, so it is a good idea to check your rate at both and see which offers you the best interest rate. Remember, checking your rate is done with a soft credit check, so it cannot hurt your credit score and will not appear on your credit report.

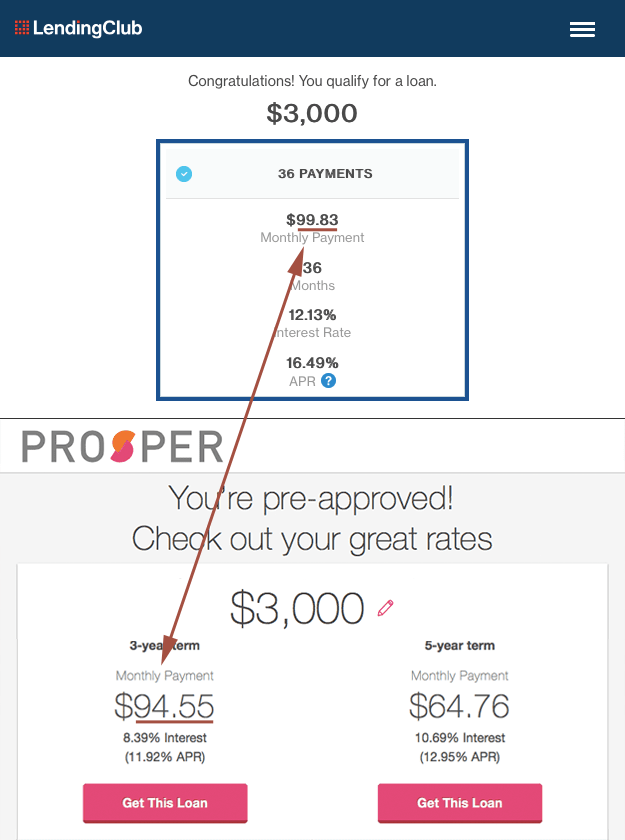

When I checked my rate on a $3,000 loan from Lending Club, the interest rate they offered me was 12.13%. Prosper offered me a loan at 8.39%:

Lending Club’s rate was almost 4% higher for the exact same loan. And the result of this higher interest rate becomes bigger on larger loans. Imagine my loan was actually for $35,000. Going with Lending Club at 12.13% versus Prosper 8.39% would have cost me an extra $2,217!

In summary, check your rate with both Lending Club and Prosper. You may end up saving yourself thousands of dollars for just a few extra minutes of work.

#2. If you have below average credit, Prosper is more likely to approve you

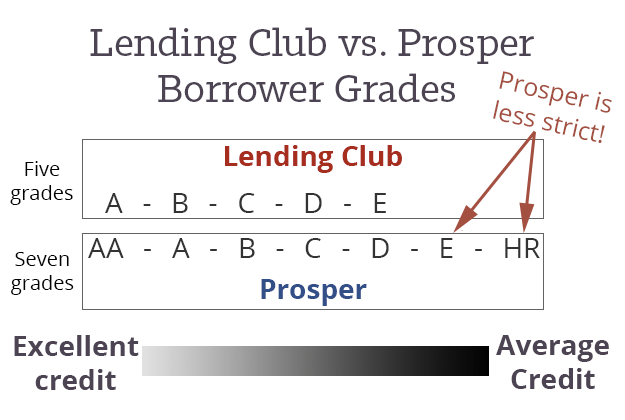

Every loan is assigned a grade by Lending Club or Prosper. This grade represents the borrower’s credit score and annual income, among other things. Higher grades (like A) are loans that are more likely to be paid back, so they are given a lower interest rate. Lower grades (like E) are less likely to pay their loans back, so they are given a higher interest rate. Lending Club offers loans to five grades of borrowers while Prosper offers loans to seven grades of borrowers:

As seen in the graphic above, the loan grades generally match up on the higher end. So A-grade loans at Lending Club are loosely the same as AA-grade loans at Prosper. But see Prosper’s two additional grades, E and HR? These are for borrowers with less than perfect credit scores, and Lending Club does not have loan grades like these two.

In summary, if your credit history is not the best (IE: if you have a credit score closer to 660) then Prosper is more likely to approve your loan.

#3. If you have an awesome credit score, Lending Club has lower fees (1% vs 2.4%)

As mentioned earlier, both Lending Club and Prosper typically charge borrowers a closing fee (also called an origination fee) of 5% when your loan is approved. So if your loan is for $2,000 then you will end up paying a closing fee of $100.

Lending Club charges people with excellent credit a fee of just 1%

That said, Lending Club charges people with excellent credit a fee of just 1%. In contrast, people with excellent credit at Prosper pay a fee closer to 2.4%, a rate that is 1.4% higher. Basically, if you have excellent or perfect credit then you might want to go with Lending Club since your closing fee could be lower. For large loan amounts this small 1.4% difference can mean saving over $500.

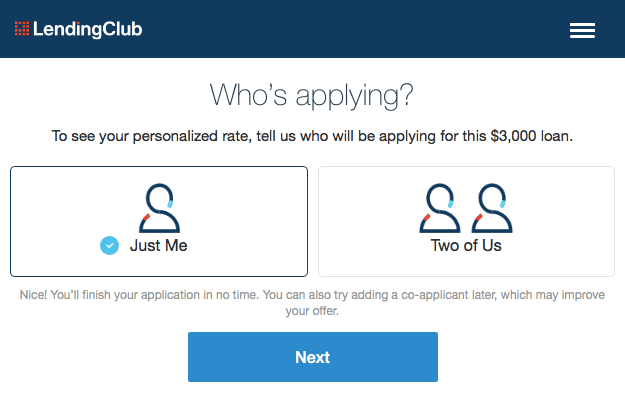

#4. Lending Club allows joint loans (two people can apply together!)

Do you have somewhat poor credit but have a friend or loved one who could cosign the loan application with you? Only Lending Club offers joint loans, meaning a loan that is applied for by two people together. Taking out a joint loan with somebody who has better credit history than you could result in higher chances of getting your loan approved, or getting approved at a lower interest rate.

Note: the person who takes out a joint loan with you is trusting you to pay back the loan on time. If you make late payments or default on your loan, it could damage their credit score. Many friendships and family relationships have been broken by joint loans that were never paid back, so think carefully before asking somebody to cosign your loan with you.

In comparison, Prosper does not offer joint loans.

#5. Prosper might transfer your money faster

I’ve taken loans out with both Lending Club and Prosper many times. Some years Lending Club seems to get people their money faster. However, in 2018 both myself and a friend of mine had our loans approved faster at Prosper than at Lending Club. With Prosper my entire process from application to receiving the money in my bank account was 2 business days. With Lending Club it was 3. I will admit this is pretty subjective. But considering both me and my friend recently had this same experience, I feel it is something readers of this article might be interested to hear.

Conclusion: Lending Club and Prosper are both great options

Both Lending Club and Prosper are good options for getting a loan. Both offer 3-year or 5-year loans up to $40,000, both have relatively low interest rates, and both have similar fees. But there are some big ways they are different:

- Do you have less than perfect credit history? Prosper might be more likely to approve your loan since their requirements are less strict.

- Do you have excellent credit history? Lending Club might charge you a lower fee of 1%, saving you some cash.

- Do you need a joint loan? Go with Lending Club. They will offer you the option to apply for the loan with another person, potentially increasing your chances of getting approved and at a lower interest rate.

- Do you need the cash as fast as possible? Consider going with Prosper. In the past year they’ve both approved me and my friend’s loan faster than Lending Club.

The best option

The best option is usually the one that offers you the lowest interest rate, so think about taking a few minutes to check your rate with both Lending Club and Prosper by clicking the buttons below:

Check both, go with the best offer

Won’t hurt your credit score.

Leave a question or comment