Each quarter I post the current state of my peer to peer lending accounts. I am a lender who enjoys maximizing my return through highly-targeted low-grade loans. I opened my first account in September 2011, and have opened two more since then. Last quarter I was uncomfortable in showing off my account values, but this quarter I have gotten over my discomfort because I want people to see how great the returns of peer to peer lending are, as well as how committed I am to it.

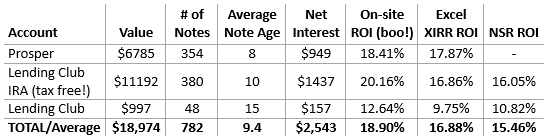

As you can see in the following table, I continue to celebrate thriving positive returns on both Lending Club and Prosper.

So many different ROIs!

Calculating your peer to peer lending ROI (return on investment) is tricky business. If you want the easy route, both Lending Club and Prosper offer you their over-inflated number. If you calculate the rate yourself using the Excel XIRR function you get closer (see my article on XIRR), but this still does not take into account any notes that have gone late (and are, as such, no longer worth their full value). Michael’s Portfolio Analyzer on NickelSteamroller includes a reduction from these late notes, so I actually prefer that calculation the most. I have included all three ROIs here for comparison’s sake.

Accounts Breakdown

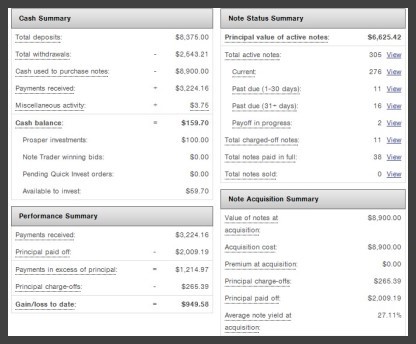

#1 – Prosper Account (17.87% return):

I live in Washington State. When Prosper recently introduced their bankruptcy protection vehicle (a very good thing), a legal issue forced Washington lenders to be barred from funding new loans. As a result, I withdrew any borrower payments rather than reinvesting them, so my overall account value went down. Thankfully, WA lenders have been recently let back onto the platform, so I am eager to get things moving again.

Overall, I am really happy with my Prosper account. I have done a good job with killer filters and am reaping the rewards for my hard work. I should probably mention how uncomfortable I am with how many of my riskiest Prosper borrowers are defaulting. A piece of me feels guilty about lending money to folks if 10% of them default on their loans. I am conflicted about whether issuing HR-grade loans to people just sets many of them up for further hardship. I will be writing a post this month about the ethics of 30% interest rates. This account only funds E and HR grade loans.

#2 – Lending Club // Roth IRA (16.05% return):

I opened this IRA last year and have put a lot of effort into learning from my past mistakes to earn the very best ROI possible. I am pleased with the resulting few late loans and defaults, though I have had some trouble finding good loans lately; they get funded so quickly and are easy to miss. This account funds E, F, and G grade loans.

#3 – Lending Club Account (10.82% return):

This was my first peer to peer lending account, and has suffered from a few beginner mistakes. This account used to fund B-G grade loans, and now it simply buys just a few $50 D grade notes per quarter.

Peer to Peer Lending Continues to Amaze Me

I am joyful that my average note age is now 9.4 months. The default rate peaks at around ten months, so while I expect some deadbeat borrowers in the coming years, I am glad to be almost over that hump. Additionally, my overall return on investment is really great at 16.88%. While it has fallen 2% since last quarter, this was to be expected because my accounts were still young. Considering my overall target ROI is 15%, I am really satisfied with my overall return.

I continue to be amazed with peer to peer lending, earning a great return for myself while helping people get free from credit card debt. Additionally, writing this post made me realize that LendingMemo launched three months ago. I have really enjoyed these last months and am excited for the road ahead.

Nice job Simon! Those returns look fantastic thus far!

How weighted are you in 36/60 month loans? I am assuming, giving your overall returns, you have a pretty substantial percentage in 60 month notes.

Thanks W2R :) Prosper is 3% 1yr; 71% 3yr; 26% 5yr. LC is 32% 3yr; 68% 5yr.

Nice job, Simon. Indeed nice to be over the hump. Given the apparent nice bump in returns you are receiving with 5-year loans, I am eager for some to mature so I can analyze them and incorporate them into my strategies. Be aware that while the fastest rate of increase in charge-offs is in the 7-10 month period (for 36 month loans anyway), they definitely continue to accumulate throughout the term. I have some nice charts I can share with you that show the patterns.

Thanks Bryce, good to know. I’m eager for the completed loan data to grow and grow.

Would love to see those charts. I’ve also realized that the goal of a 15% return is highly unreasonable, so I’m going to try to shoot for 12% instead.

This is fascinating. I didn’t know about peer to peer lending until I received some offers for loans in the mail. At first I thought they were some sort of scam, which is how I found your article. Is there an advantage for borrowers using peer-to-peer over bank loans or loans from more traditional sources? I do have some short term need but expect that to be short-lived. Once I get through the next year or two, I would be interested in looking into being a lender with these companies! It sure beats a half percent interest in a saving account. I LOVE the idea of a Roth IRA directed into peer-to-peer lending!

Thanks for the tutorial.

Hi Carol. The advantage for borrowers is that they get a better rate than a bank, and the application takes way less time.

Thanks for stopping by. :)

Hi Simon:

Could you compare lender withdrawal of their investment between Prosper and Lending Club. I am a new LC investor but since I realize there is no way we can get the money out if we need to use it for emergency. LC has a trading platform that one can sell notes at “market” price, so most likely investor like me has to take loss if we want to get the money out thus wipe out the profit we made in the process. Because of this reason, I decide not to put too much money in this type of account. Does Prosper does better? Any comments, suggestions would be greatly appreciated.

Huina Smith

Hi Huina. The short answer is that you do not have to take a loss on your notes. Healthy notes on Lending Club sell for a premium, and may sell within minutes if you price them at cost (taking neither a loss or a profit). But your question is a good one, and is fully answered here: https://www.lendingmemo.com/introducing-the-liquidity-project/

I love this idea. Thanks for the information. My instinct was to invest in the higher APR/lower credit rating loans, but I’m a little bit of a risk-taker.

Totally. I’m a big fan of the low grades.

I know this post is a little old but I still found it interesting. I have never used Lending Club before so this was eye opening to me.

Great stuff! Just getting starting in P2P. I hope it doesn\’t go mainstream as this will lower returns significantly as capital flows into the market. If hedge funds or big money management firms poured money into this, returns would be cut fast!

Do you have experience with platforms in Asia or Europe? Or bitcoin based platforms? I don\’t trust leaving my money in the U.S. system. Lawyers, creditors, ex-wives, IRS…..list goes on and on.