I just returned yesterday from the annual LendIt conference in San Francisco, a hearty gathering of investing professionals dedicated to exploring how the internet is transforming American finance. Lending Club and Prosper, obviously the industry’s biggest hitters, contained the largest presence at the event, giving rousing speeches that packed out the grand ballroom of the Union Square Hilton Hotel downtown. The sheer excitement people have for these two platforms alone was an amazing thing to experience.

My responsibility throughout the two-day event, however, was leading the smaller workshop/demo track, basically the room where companies could come and give short seven-minute presentations about their work, perhaps leading the audience in a demonstration of their company’s product via a projected web browser. The entire room could only seat a few hundred people at most, so while Lending Club and Prosper remained in the larger presentation hall, I had the very real privilege of meeting the founders and developers of these smaller companies first hand.

Introducing fifty different companies over a period of two short days, I met a wide-ranging collection of professionals covering nearly every facet of online lending. Getting introduced to all of these talented people and their companies turned out to be a huge opportunity for me to receive a crash course in the online lending movement. Lending Club and Prosper remain the only two options available for unaccredited investors, the focus of this site, so the lion’s share of my attention has historically been given to them. However, this firm focus has also meant that I have largely abstained from the wider conversation around finance and technology in general, a lack of awareness that changed for good at LendIt 2014. Introducing fifty startup presentations in 48 hours meant receiving a sudden bird’s-eye macro-level view of internet-driven finance, a jump into the deep end of online lending itself. Now that the conference is over, I have a lot of thoughts about the industry as a whole, a few critiques, but largely a feeling of amazement toward what is happening in our world today.

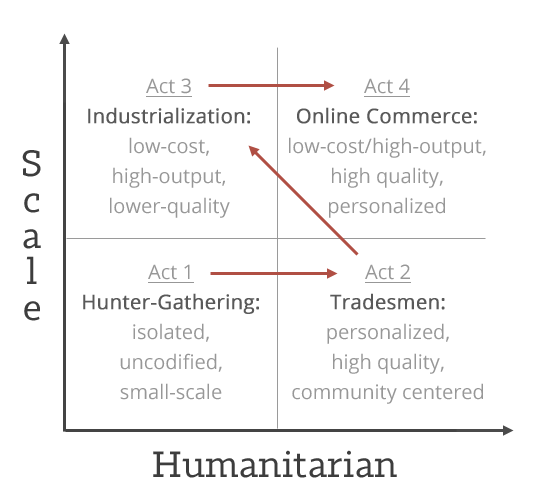

A perfect illustration of the how the web is transforming the American economy was given in a talk by David Snitkof of Orchard Platform. During his short workshop/demo presentation, David shared a graph that looked something like this:

As a caveat, I recreated this from memory, so forgive me if I get some of the titles wrong, but I feel the gist of his graph is adequately represented.

Human economies began as hunter-gatherers, but soon evolved into tradesmen (like cobblers and blacksmiths) who could add expertise and personalization to the products people needed. The industrial revolution then added incredible scale to this economy, but at a cost of making it both lower-quality and impersonal.

The LendIt conference heralds the arrival of Act 4, how the influx of technology and the internet is forming a new economy that is both large-scale and humanitarian. For example, a peer to peer lending company like Lending Club uses risk-based pricing to give people an interest rate on a loan that is more appropriate to their situation (personal), yet is able to issue billions of dollars of these personalized loans using just a few hundred employees (scale). David’s point was that the internet is simply grabbing an already-scaled global economy and reforming it into something more excellent and human.

By the end of the conference, I had to agree. For example, I was truly amazed by the presentation Dave Girouard gave regarding his company Upstart. For those unaware, Upstart offers loans to people who have yet to build any credit history, but who are fresh graduates from promising colleges. Considering many grads have not yet had the chance to develop a FICO score, a great number of responsible deserving individuals are unable to get a loan. But Upstart has developed a novel risk-model that determines creditworthiness based on factors like a person’s academic transcripts. And so, just like Act 4 in David’s graphic, Upstart has invented a scalable business model that utilizes technology and the internet to offer a service that people deeply need. To boot, their company had arguably the most beautiful website at the entire conference.

By the end of the conference, I had to agree. For example, I was truly amazed by the presentation Dave Girouard gave regarding his company Upstart. For those unaware, Upstart offers loans to people who have yet to build any credit history, but who are fresh graduates from promising colleges. Considering many grads have not yet had the chance to develop a FICO score, a great number of responsible deserving individuals are unable to get a loan. But Upstart has developed a novel risk-model that determines creditworthiness based on factors like a person’s academic transcripts. And so, just like Act 4 in David’s graphic, Upstart has invented a scalable business model that utilizes technology and the internet to offer a service that people deeply need. To boot, their company had arguably the most beautiful website at the entire conference.

Upstart was just one of many. Throughout the day, I continued to be amazed by intelligent, heartfelt individuals who had found creative, tech-based approaches to solving society’s credit issues in a way that could nationally scale. Noah Breslow from OnDeck gave a talk that made issuing small business loans sound heroic. Jared Hecht showed how his company Fundera has developed a clever online marketplace for offering businesses loans. Peter Behrens from the UK-based p2p lender RateSetter spoke about how his company actually dressed up as zombies and roved the streets of London to raise awareness of the fact that 80% of people in the UK have “zombie” bank accounts, meaning savings accounts that return less than the rate of inflation, and thus could be classified as living-dead.

Fifty presentations in two days sort of began to blur together for me by the end, and a wider view began to take shape. First, I was amazed by the degree of intelligence within this movement. Many of the conferences I’ve attended over the years that emphasize the arrival of technology are largely motivational in nature. In contrast, online lending in general (and LendIt in particular) is largely empowered because it is smart. You simply cannot scale a credit-model without statistics, and you cannot base a company around statistics without having some very intelligent people on board. Full stop.

Secondly, I have to admit how moved I was by the palpable courage of the online lending movement. While an element of money-hunger was certainly present if you sought it out, the overwhelming majority of people I introduced in the workshop/demo-room revealed themselves to be experts who believed in their work because of the service it provided to people who need it. Whether it was helping small businesses, empowering fresh graduates, or simply consolidating ugly credit card debt into something more simple and manageable, the startups who embody this renewal of the American financial sector contain a heart-warming degree of kindness and humanity.

Maybe this quality is simply representative of this industry’s naïve beginnings. Perhaps, decades from now, we will look upon the idealism of these earlier years as indicative of the movement’s initial youth and venture-funded roadmaps.

However, I think another real possibility exists, the possibility seen in David Snitkof’s chart. These tech-based financial startups may be cutting out the banks and reforming American finance, not through offering still-larger opportunities to scale, but for the element of humanity they can inject into the sizable economy that already exists. In this way, the intelligence and kindness of this movement may be the very driver of its success, and thus a permanent characteristic of national finance moving forward.

Thanks so much, Simon, for the inspiring synopsis!

My pleasure Dara. What a week this has been.

Great summary. As a clue to those new to all this, I loved these 5 types (categories) of p2p retail lenders. I’m sure many of us fall into more than one type: http://p2plendingexpert.com/which-type-of-peer-to-peer-lending-investor-are-you-im-3/

Simon – this is a great summary and you did a great job at the conference. I wrote down one quote from the conference and it was from David Snitkof’s excellent presentation: “technology allows humanity to scale” … pretty much captured the essence of the conference for me.

Thanks Jason. It was a privilege. Huge thanks to you and your team for organizing such an outstanding event.

Great post. I like the company that dressed up as zombies, good marketing technique.

Great article! That chart really captures human economies.