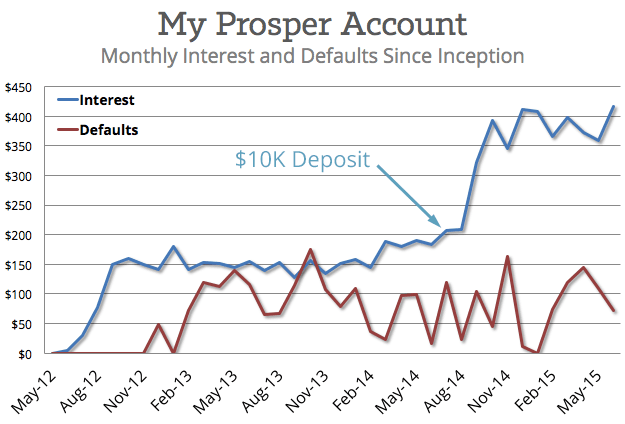

To encourage more people to start investing, each quarter I post the current state of my personal peer to peer lending accounts.

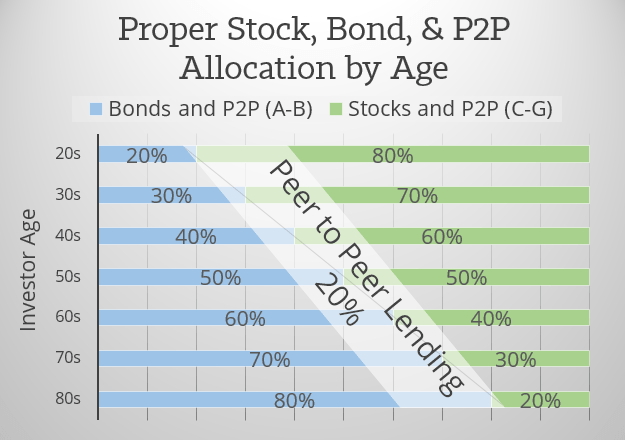

Because of my age and life-situation (32 – single), I am an investor who feels comfortable taking on more risk. While this means my returns are potentially higher than average, it also means my portfolio is more susceptible to macro economic factors like a rise in national unemployment.

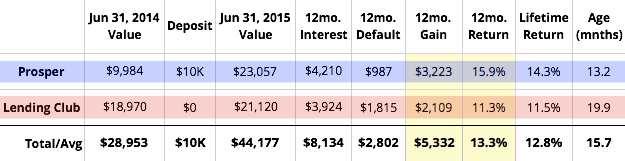

Q2 of 2015 Breakdown (Trailing 12 Months)

Into mid-2015 I continue to celebrate great returns at both Lending Club and Prosper:

Notes:

- Account values, defaults, and interest are pulled from each platform’s monthly statements (See your Lending Club Statements or Prosper Statements).

- The important figure of 12mo. Gain (highlighted in yellow) is calculated by taking the interest paid over the past twelve months and subtracting that period’s defaults.

- The 12mo. Return, also highlighted in yellow, is done via XIRR (see: XIRR calculator), the best way to independently calculate your peer to peer returns. Most investors will probably not need to go to such lengths, and can trust the onsite return at Lending Club or Prosper.

- With an average age of 13 months, the notes in my Prosper account are not yet seasoned. Read: The P2P Return Curve

- All earnings are pre-tax.

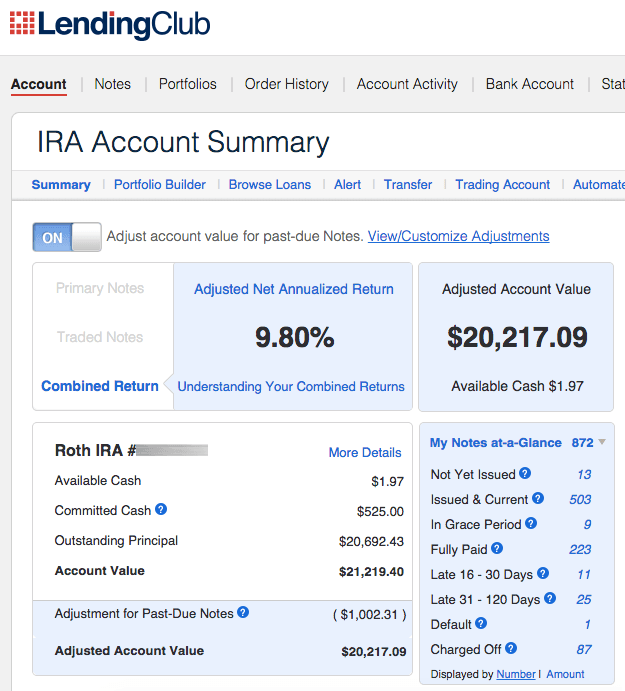

Lending Club IRA: Earning 11.3% Interest

Over the past year my Lending Club account continued to pay out a welcome 11% ROI. I attribute filtering and a focus on riskier E-grades as the main reasons for this success. See my Lending Club filters.

As a Roth IRA, these earnings accrue tax-free, which is helpful considering the interest does not receive a special tax treatment like capital gains. Also, during this year we’ve seen Lending Club continue to drop their interest rates, and investor returns have fallen by 2% since 2013. But my account seems less impacted by this change since 90% of my notes are in 5-year loans. This will change eventually though.

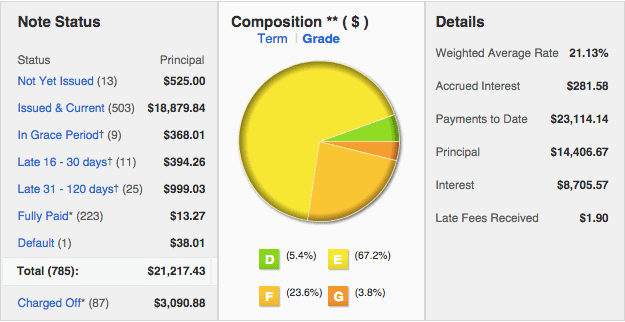

Here is another breakdown:

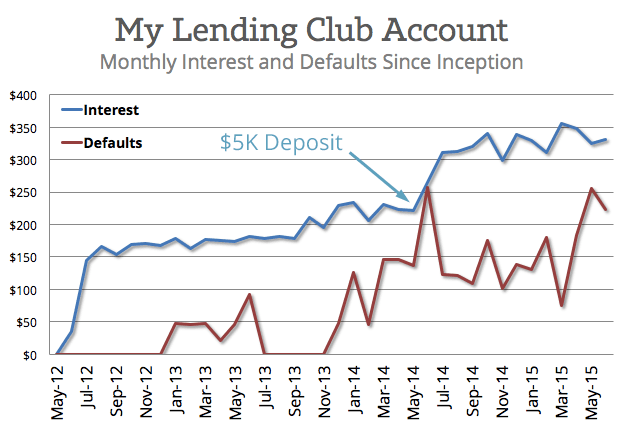

The biggest item of concern has been the amount of principal in notes over 31 days late (currently $999). This number continues to rise each quarter, recently delivering the biggest three-month default period since the account began. See below:

The large spike in defaults on the far right is three months (April, May and June) each above $180. The annualized return of this quarter was just 6.8%, a far cry from the 11% earned over the past twelve months. It will be interesting to see if the following months continue this trend.

Another fun thing is the $5,000 contribution in May of 2014. You can watch the payments from interest grow after this deposit is made, and continue to trend upward as the investment exponentially grows. Potentially, the recent rise in defaults is related to this contribution 13 months ago.

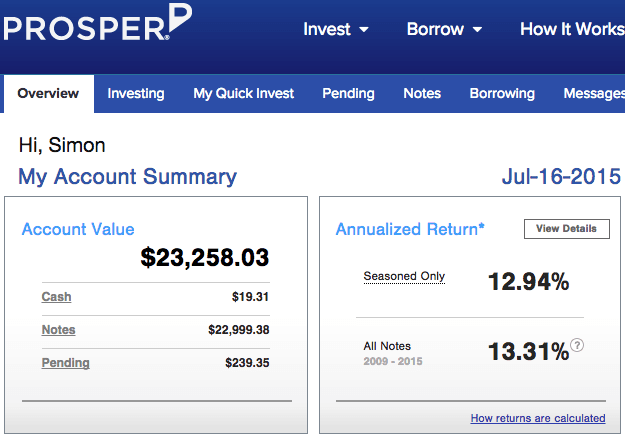

Prosper Taxable: Earning 15.9% Interest

While my Prosper account earned almost 16% this month, this return is not sustainable. The account nearly doubled in size less than a year ago, so the majority of loans have yet to mature. Many are set to default in the coming quarters. That said, I do believe it will end up earning a higher ROI than my Lending Club account, and I attribute this to the wider credit spectrum that Prosper offers (their E and HR-grade loans can be riskier than Lending Club’s G-grades). I also believe Prosper’s underwriting is slightly better.

Some of this success comes from the filters I use (see them here) as well as an API to grab the rarer D/E/HR grades.

I don’t understand why my XIRR calculation gives me a full percent higher ROI than Prosper’s onsite figure (14.3% vs 13.3%). Typically this is the other way around, with onsite ROI figures not accounting for cash drag. Any ideas?

Another breakdown:

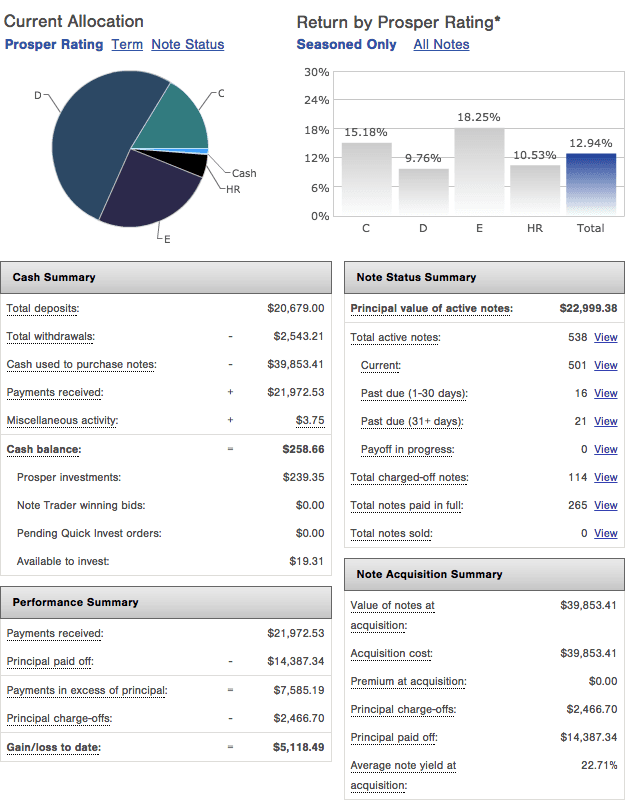

Further evidence of the oncoming defaults is seen below. The $10,000 deposit made in late July has caused the monthly interest payments to nearly double in size, yet defaults remained constant for two years.

I am going to make a prediction: next quarter will have a record number of defaults for my Prosper account.

A Word on Mature Returns and my Non-P2P Investments

One fair critique that people have against this investment is that people with public investments, like myself, continue to add to them, and thus the accounts never mature and the ROI remains artificially inflated.

To answer this critique, I’ve decided to stop making further deposits into these accounts for the next twelve months. I want to see what they earn per year if left completely on their own. Already the Lending Club account has not had a deposit for over a year, and next quarter the Prosper investment will be in the same boat. It will be interesting to see where the ROI settles at, particularly with such a focus on 5-year loans.

This allows me to focus on the non-p2p sides of my retirement accounts, namely stock and bond investments. As I’ve mentioned earlier, I think many investors should hold 20% of their investable assets in peer to peer lending, which leaves 80% to other investments.

I’m interested to see how these grow vs. peer to peer lending in the coming year. My assumption is that my bonds (intermediate term corporate and government) will have the most consistency per decade, followed by peer to peer lending, with stocks and REITs (held in low cost index funds) having the highest yield but lowest consistency.

It will be interesting indeed to see the performance of these accounts without future contributions.

Cheers!

Dominic

Totally. The final equilibrium will not be hit for many years, but even another 12 months should give a clearer picture of what we can expect. I’m eager to see your own returns Mr. Gen Y!

sooo it’s been almost a year. what’s the final word?

Hi Simon,

It’s very interesting your graphical 20/100 allocation in P2P. It’s inn line with Lending Robot study.

I actually invest 15/100 of my portfolio in my country (Spain) in P2B.

Greetimgs.

Jorge

Why 20 % only in p2p lending out of the overall portfolio.? What is the mathematical theory behind that assessment?

Are you experimenting mostly with new notes, or buying and selling on the trading platforms as well? How have your results been on trading platform vs. net new?

You mention as a younger investor you are taking higher risks for potentially higher returns. However, the returns that matter are the returns over the complete business cycle. It may turn out that investing in higher quality A and B grade loans outperforms your strategy.

I’m just formulating my strategy but I’m thinking along the lines of keeping the P2P part low risk and taking risk in the stock portion. For example I could keep reinvesting loan payments in new notes while the CAPE is high. When CAPE drops below say 15x I could then divert loan payments into stocks. If I were mainly in C-G grades, at the precise point I needed the cash for stock investments defaults would be rapidly increasing and reducing my loan payments. The opportunity costs of not investing in stocks at low valuations could outweigh any gains from higher risk notes in the good times.

Hi, new to LC and your site. Love the writing and the detail explanation on the purpose and the reason why. This might be a silly question but why do you exclude the state of CA and FL for your LC filter? I would think those states are above US income average. Thanks.

Hi Jack. See here: https://www.lendingmemo.com/filters-lending-club-prosper-2015/ and here https://www.lendingmemo.com/redlining-florida-lending-club-prosper/

Enjoyed watching your vids and reading up on articles, any updates?

Perhaps soon. We’ll see.

I’m interested in some updates as well!

Regards,

I recently got into P2P and sent $25,000 of my ROTH account over to Prosper…..couldn’t do Lending Tree from my State. I’m certainly more diversified/conservative than you with my current breakdown like this:

AA – 14%

A – 20%

B – 22%

C – 20%

D – 16%

E – 8%

HR – 0%

Cash – 0%

My projection with this mix is 7.4%. It will be interesting to see how yours finishes.

Wow no updates in exactly 2 years. Did they all default? Why no updates?