If you are someone with bad credit history, getting a personal loan can be a real challenge. If you apply for a loan at your local bank or credit union, you get denied. Another option is a cash advance loan (sometimes called a payday loan), but the interest rates on these loans can be between 150% and 600% per year! So which is better? Getting denied, or paying through the nose?

The best option for people with bad credit is to check their rate on a peer to peer loan. Here are five reasons why you should apply for a peer to peer loan if you have below average credit:

Reason #1: Your credit might not be as bad as the bank said it was

Whenever a bank or a loan company looks at your application and decides to approve or deny it, they are going to compare your application to what has worked for them in the past. For example, people who earn a lot of money each year typically pay back their loans better than people who earn very little money each year. There are literally thousands of things to look for in a borrower, so anybody giving out loans needs a large amount of information to guide their decisions.

But banks and credit unions have not always been very good with technology. The latest bank software can be expensive, and updating a bank’s computers can be a lot of work. You can even see this in the websites of many banks, which can look clunky and out of date.

For example, here’s a credit union’s website I found that is not even optimized for mobile phone browsers:

In comparison, a peer to peer lender like Prosper has the latest technology at their fingertips, and this means they often have a lot more information available to make decisions about who should get approved for a loan and who should get denied. Since they often have better data and better technology, their calculation about who should and should not get loans is more accurate.

If you have had a bank tell you that your credit score is too low to get a loan, maybe it is because they do not see the full picture of who you are! Maybe an online lender like Prosper, a technology company with better data and algorithms, will see your credit history more accurately and realize that you are actually qualified to receive a loan.

Reason #2: Checking your rate cannot hurt your credit score

Perhaps you feel you’re right on the line for getting denied for a loan, and you have to be careful about where you apply because you know each application dings your credit score a little, temporarily reducing it by a few points. Perhaps you don’t have any extra points to lose. Where can you apply for a loan with such little slack?

A peer to peer lender like Prosper is great because the process of checking to see if they will approve or deny your loan is done with a soft credit check (also called a soft credit pull). A soft credit check does not appear on your public credit history, and as a result, it cannot lower your overall credit score. As a result, you can literally check your loan rate every hour of every day of the year at Prosper, and your credit score will never be affected.

That said, if you actually accept the loan offer and submit a loan application, Prosper will then do a hard credit check (also called a hard credit pull) on your credit report, which will temporarily lower your credit score by a few points for six months, and will remain on your report for exactly 2 years, so only apply for a peer to peer loan once the loan offer is exactly to your liking.

Reason #3: Peer to peer loans have riskier borrowers than bank loans

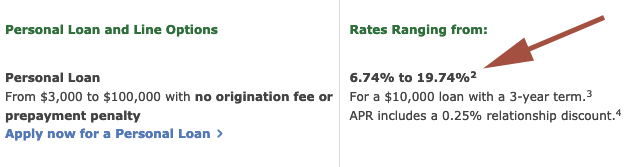

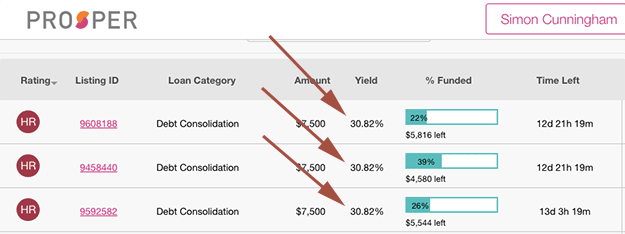

A bank’s old technology stops them from offering loans to people with less than perfect credit. Why is this? Because their loan application is not as fine tuned as a peer to peer lender like Prosper. Since a bank has less accurate data for who will and will not pay back their loans, they have to play it safe. They an only offer loans to people with good or nearly good credit. A great example of this is seen below:

This picture was taken from the website of Wells Fargo, one of the biggest banks in America. It shows the different interest rates offered on their personal loans: from 6.7% (perfect credit) to 19.7% (average credit). But Prosper offers loans with interest rates above 30%, a rate high enough to indicate that they offer loans to people with much worse credit than Wells Fargo:

Hopefully you are not in such desperate need for a loan that you would actually accept a 30% interest rate. But if you are that desperate, and your credit history is poor enough that you would be denied for a loan anywhere else, then it’s nice to know that Prosper is an option for you. Note that Prosper allows you to pay your loan back early without a penalty, meaning the actual interest rate on this loan could become much lower than 30% if you paid the loan off early.

The question remains: how can Prosper approve more kinds of borrowers, particularly people with imperfect credit histories? The answer is that their approval process is much more fine-tuned than a traditional bank since they have more data at their disposal. As a result, they can take on more risk with who they approve. If you’re someone with less than perfect credit history, this is great news.

Reason #4: Peer to peer loans can be smaller than bank loans

Big banks often require bigger loans. Since their technology is so clunky, their cost of business is somewhat high, so they need bigger loans to make sure they turn a profit on every loan. A great example of this is again Wells Fargo Bank, whose smallest loan is only $3,000.

In comparison, a peer to peer lender like Prosper offers loans as small as $2,000. Their loan company is much more efficient than Wells Fargo, so they can still turn a profit on loans that are very small. And if you’re someone with less than perfect credit, your chances of getting approved go up if you apply for a smaller loan.

All in all, if you are someone with bad credit who has to apply for a smaller loan in order to get approved, a peer to peer lender is a much better option.

Reason #5: Peer to peer loans have a fixed interest rate

Finally, a great reason to apply for a peer to peer loan if you have imperfect credit is the fact these loans have a fixed interest rate, meaning the interest rate will never ever go up. Even if you are late on a payment, your interest will remain the same as it was when your loan was approved.

Here’s an example to show how great this is: sometimes people work at jobs that earn different amounts of money during different months, like how a waitress might earn a higher salary in December than January because people tip less after the holidays have ended.

If this is your situation, and you already know that some months you are going to be late on a payment, then a credit card would be a terrible thing to use to rack up debt, because many credit cards have variable interest rates that will go up if you make a late payment. In comparison, the interest rate on a peer to peer loan will always stay the same. People with inconsistent income streams would be less penalized.

For people with bad credit, a peer to peer loan can be a great option!

If you are someone who the banks have said has bad credit, you might want to consider a peer to peer loan.

A peer to peer lender like Prosper often has:

- Better data to more accurately say if you should get a loan

- A wider credit spectrum (they give loans to riskier borrowers)

- Smaller loans that are easier to get approved for

- Fixed rates (the interest rate will never change)

- Soft credit checks so you can check your rate risk-free

If this sounds like something you might need, click the button below to see what kind of rate Prosper offers you:

Won’t hurt your credit score.

[Image credit: eflon “Untitled” CC-BY 2.0]

Interesting.