Many people like peer to peer lending for its low loan rates. Others celebrate its consistent and generous ROI. But the truth is that neither of these benefits are very profound. For example, while it is crucial to get out of debt (perhaps through a p2p loan), the process isn’t all that fun. Quite the opposite; making those monthly payments can be a real chore. This applies to investing as well. Earning a return is key to a healthy retirement, but it really isn’t all that interesting. A dull number on your screen slowly grows over a 2-4 decades until a certain retirement threshold is reached and you’ve “made it” — a long time to wait for a party.

My favorite part of peer to peer lending is something altogether different. What captivates me is its transparency and collaboration. Certainly competition exists, but the long storied history of peer to peer lending is really one of people figuring this out together.

To illustrate this, today I’ll review every peer to peer lending website in the United States, highlighting the part they play in the overall lending ecosystem.

Two American p2p lending companies

Many online lending companies have launched in the United States, but only two are purely peer to peer. Only two connect everyday investors to borrowers: Lending Club and Prosper. Additional platforms will launch in the future, but for now these are the sole two.

Lending Club

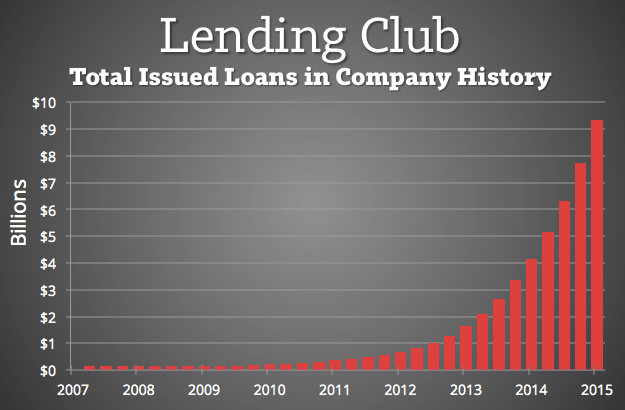

You really can’t talk about peer to peer lending without starting with Lending Club. The industry leader, founded in 2007, has gone on to issue over $9 billion in loans. Their site has the best user interface and the largest 3rd-party investor ecosystem. Recently, Lending Club went public on the New York Stock Exchange, becoming the first publicly traded online lender in history.

You really can’t talk about peer to peer lending without starting with Lending Club. The industry leader, founded in 2007, has gone on to issue over $9 billion in loans. Their site has the best user interface and the largest 3rd-party investor ecosystem. Recently, Lending Club went public on the New York Stock Exchange, becoming the first publicly traded online lender in history.

They offer loans between $1,000 to $40,000. Interest rates range from 6.6% to 29.9%. Their average loan is for $15,000 and has a 13.4% APR. Read: our Lending Club review for borrowers.

Lending Club investors: typically earn between 5% and 9%, depending on how much risk is taken on. Read: our Lending Club investor review

Prosper Marketplace

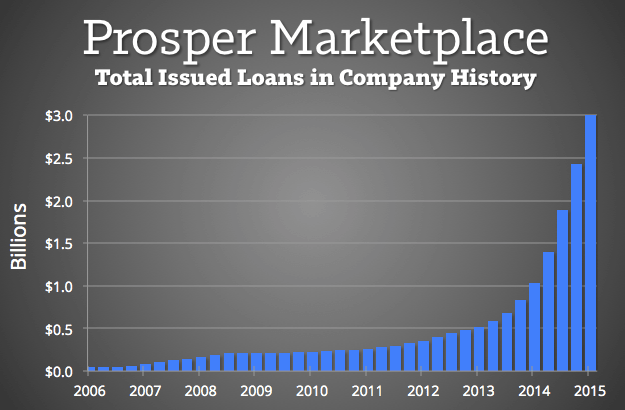

Prosper made history when they launched in 2006. They were the first ever American peer to peer lending company. Since then, the company has experienced tremendous growth and success, having recently issued an incredible $3 billion in loans. Recently, they were named by Forbes as one of the most promising companies in America.

Prosper made history when they launched in 2006. They were the first ever American peer to peer lending company. Since then, the company has experienced tremendous growth and success, having recently issued an incredible $3 billion in loans. Recently, they were named by Forbes as one of the most promising companies in America.

Prosper offers loans between $2000 and $35,000. Interest rates range from 6.6% to 35.9%. The average loan at Prosper is for $13,000 and has a 13.9% interest rate. Read our loan review for Prosper.

Loans up to $40,000

Check your rate at both, go with the lower rate.

Won’t hurt your credit score.

Prosper investors: typically earn between 5% and 9.5% depending how much risk is taken on. Read: our Prosper investor review

Peer to peer lending news and education sites

A wide variety of news and education sources have sprung up around these two companies.

Lend Academy

Peter’s Lend Academy blog has been the go-to source of anything involving online lending for years. His approach to lending basics and filtering is how many of us got our start. Week after week, him and Ryan continue their coverage of the latest p2p lending news and analysis.

Peter’s Lend Academy blog has been the go-to source of anything involving online lending for years. His approach to lending basics and filtering is how many of us got our start. Week after week, him and Ryan continue their coverage of the latest p2p lending news and analysis.

CrowdFund Insider

Crowdfund Insider is probably the most prolific lending news site in the nation. For example, they published thirteen news stories today alone (May 8). Lending Club and Prosper are common featured stories here. Also, if you’re interested in the wider non-P2P lending space, CFI has got you covered there too.

Crowdfund Insider is probably the most prolific lending news site in the nation. For example, they published thirteen news stories today alone (May 8). Lending Club and Prosper are common featured stories here. Also, if you’re interested in the wider non-P2P lending space, CFI has got you covered there too.

Orchard Platform

Orchard is another mainstay in the peer to peer lending world. Though their main offering is technology for institutional investors, Orchard’s blog has continued to be a wonderful source of interesting and novel analysis of Lending Club and Prosper’s open data.

Orchard is another mainstay in the peer to peer lending world. Though their main offering is technology for institutional investors, Orchard’s blog has continued to be a wonderful source of interesting and novel analysis of Lending Club and Prosper’s open data.

OrchardPlatform.com/blog/ (May no longer work since Orchard was acquired by Kabbage)

P2PLendingExpert

Stu Lustman is a credit professional who brings his own value to this space. Furthermore, he has a unique take with peer to peer Bitcoin lending.

LendingMemo

Launched in January 2013, this site continues to be a joy and privilege to work on. Thanks for reading :)

Secondary blogs

Even though PeerCube and LendingRobot are more known for their savvy p2p tools, they operate blogs on the side that are filled with interesting and helpful information on this investment.

PeerCube Blog: PeerCube.com/blog

LendingRobot Blog (now owned by NSR Invest): blog.LendingRobot.com

P2P investing and analytics tools

Since all of peer to peer lending’s data is available to the public, and both the platforms allow access to their sites over API, a large tool ecosystem has evolved that offers investors a deeper way to analyze and invest in these loans.

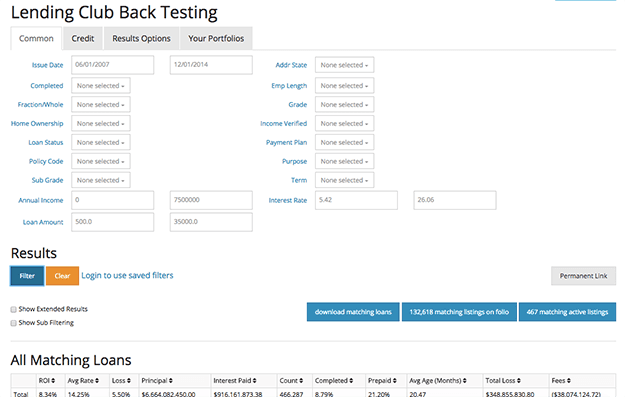

NSR Invest

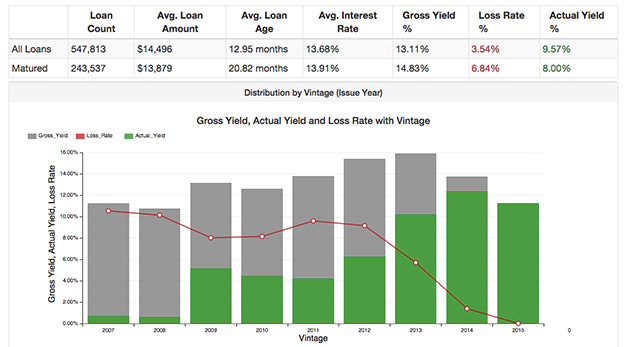

Probably the main investor analytics site for years has been NSR Invest (originally Nickel Steamroller). NSR offers a fast and robust backtesting tool that allows investors to breakdown the historical loan data in pretty much any way they desire.

Probably the main investor analytics site for years has been NSR Invest (originally Nickel Steamroller). NSR offers a fast and robust backtesting tool that allows investors to breakdown the historical loan data in pretty much any way they desire.

On top of that, they offer great charts of industry growth, the most advanced portfolio analysis in the country (including Prosper), and fund management for accounts over $10,000.

Serves: Lending Club and Prosper

Cost: NSR Platform is free! (NSR Invest costs from 0.45% to 0.9%)

LendingRobot

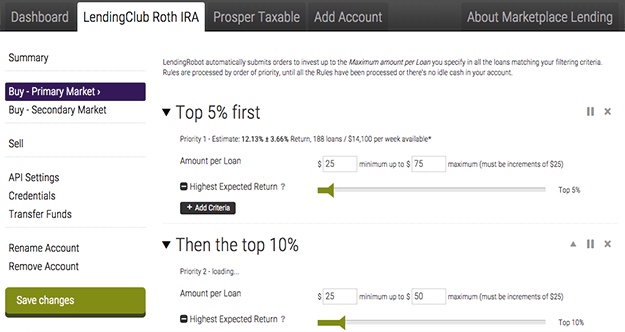

LendingRobot is the biggest auto-investing tool in the space, having received a lot of positive press as of late (TechCrunch). Their tool automates Lending Club and Prosper investments in a variety of interesting ways. Not only can you auto-invest with filters (video), but their Estimated Return parameter invests with an algorithm, allowing you to increase your returns without needing to learn filtering at all. They have pre-set filters for conservative and aggressive investment strategies.

LendingRobot is the biggest auto-investing tool in the space, having received a lot of positive press as of late (TechCrunch). Their tool automates Lending Club and Prosper investments in a variety of interesting ways. Not only can you auto-invest with filters (video), but their Estimated Return parameter invests with an algorithm, allowing you to increase your returns without needing to learn filtering at all. They have pre-set filters for conservative and aggressive investment strategies.

Lately, LendingRobot even added functionality for the Folio secondary market, allowing you to automatically place loans for sale on Folio that, for example, drop a certain amount in FICO.

Serves: Lending Club and Prosper

Cost: free for small accounts, 0.45% of investment for accounts > $10,000

LendingRobot.com Update: LendingRobot has been acquired by NSR Invest

Peer Cube

Anil Gupta’s PeerCube has its own dedicated following. Of all the tools in this list, PeerCube is probably the most detailed. It has large descriptive charts for everything: from the average markup of loans on Folio to which year of your investment earned you the most money. The list really is too long to cover in a single paragraph.

Anil Gupta’s PeerCube has its own dedicated following. Of all the tools in this list, PeerCube is probably the most detailed. It has large descriptive charts for everything: from the average markup of loans on Folio to which year of your investment earned you the most money. The list really is too long to cover in a single paragraph.

Further, it can take this analysis and automatically invest in loans on your behalf at both Lending Club and Prosper. Pretty great!

Serves: Lending Club and Prosper

Cost: Pro Plan is $19/month (free option available)

Interest Radar

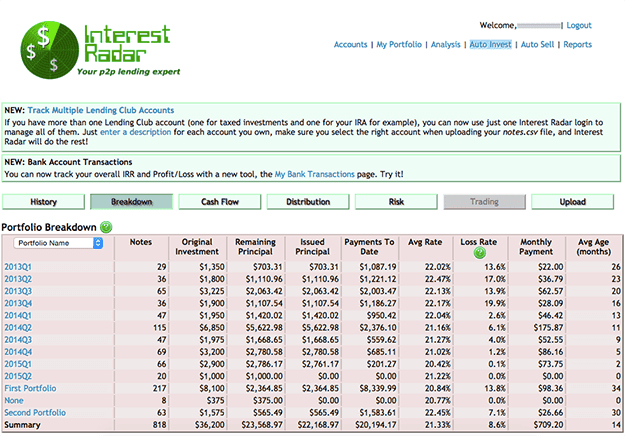

Rev’s investing tool Interest Radar has been a trusted method of investing for many years. It was the first to allow automated investing through Lending Club, and contains a large degree of secondary functionality. For example, here Interest Radar has broken down my Lending Club returns by portfolio.

Rev’s investing tool Interest Radar has been a trusted method of investing for many years. It was the first to allow automated investing through Lending Club, and contains a large degree of secondary functionality. For example, here Interest Radar has broken down my Lending Club returns by portfolio.

Interest Radar also offers auto-sell features for your Lending Club Folio account. If one of your loans drops a certain distance in FICO, it can automatically place the loan on the secondary market for you.

Serves: Lending Club

Cost: 30 days free (then $9/month or $59/year)

Peer to peer lending discussion

Here are the four main places people discuss peer to peer lending:

Lend Academy Forum

Peter’s forum over at Lend Academy remains the most active discourse on the internet, with a diverse community of lenders in talks about a multitude of topics. It has sections for both Prosper and Lending Club, as well as all the major tools.

Hashtag: #p2plending

/r/SocialLending: Reddit.com/r/SocialLending

[image credit: Wyman Laliberte “1917 Map of Winnipeg” CC-BY 2.0]

Looks like Bluevestment charges you based on notes invested for you and not on account value. It is free if you invest <$1000 per monthly cycle.

Thanks for the great info Simon!

Updated. Thanks Brandon.

Simon,

Perhaps I am looking at this too simplistically, but I am concerned about the risk needed to make even the stock market average return by using P2P.

Let’s say I used $5000 to fund a P2P account. If I were to invest it in loans that paid 10% annually over 3 years, using an amortization calculator, I would accrue $808.09 in interest payments. However, Prosper states that over the course of 3 years, it would charge $80.70 in fees. Thus, my net profit would be $727.39 during that time. This of course assumes no charge offs during time which seems highly unlikely.

Instead, let’s say I invested that same $5000 in another investment. In order to make $727.39, I would only need an annualized gain of about 4.65% for three years (for a total gain of $730.43). That seems quite doable.

Am I missing something?

Thanks,

-Joe

Hi Joe,

Most investors simply cannot make the stock market average in p2p. The average investment is probably something around 6%. See today’s post: https://www.lendingmemo.com/average-investor-return-lending-club-dropping/

Simon

There is no direct comparison between return from P2P loans versus other investment (ex: stock) due to difference in when original investment is received back. With stock, you receive the original investment plus any gains at the time of stock sale. With P2P loan, you receive a fraction of original investment plus interest every month. P2P loans are amortized loan.

With stock you invest $5,000 and at the end of 3 years you receive $5,000 of original investment plus gains of $730.43 for the annual gain of 4.65%. This stock is equivalent of a 3 year bond with coupon rate of 4.65%, interest and original investment payable at the end of 3 years.

With 3 year 10% $5,000 P2P loan you receive $161.34 every month which includes interest plus a small fraction of original investment for 3 years.

For example, first month payment of $161.34 includes $41.67 in interest and $119.67 in original investment. In first month, you gains were $41.67/$5,000 = 0.83%.

Unlike with stock where all of your original investment $5,000 was locked for 3 years, with P2P loan, your original investment $5,000 was locked for one month, and after one month only $4,880.33 of original investment is still locked. To do a fair comparison between P2P loan and stock, you will need to re-invest $119.67 of original investment you received for another 2 year and 11 months.

I hope this explains your confusion.

@joe, P2P lending is also different from stocks in that diversification is free. For stocks, there’s a price based on trade commissions when you acquire the portfolio as well when you rebalance it. Risk-adjusted, the returns are significantly better than almost every other investment asset class out there. Couple that with automation of the investment process, it’s difficult to not participate in this movement.

Lending Alpha provides a completely automated experience (curated loan selection strategies, dynamic trade execution, and continuous portfolio optimization).

Simon

Your title implies that you’ll be naming services other than Lending Club and Prosper. What about Upstart? What others are out there?

Hi Tom. Upstart is a great lending company, but they are not peer to peer because you have to be an accredited investor to participate. Just Lending Club and Prosper are open to unaccredited retail at this time.

What are the other sites for accredited investors? Which is best?

Hey Simon,

Thanks for the helpful article. Why would having accredited investors vs. non-accredited investors distinguish whether it’s a p2p lending site? As this is an exhaustive review, I’d imagine you’d still add it as an option and mention that it’s open to accredited investors.

Thanks,

Dave

Peer to peer lending at its core is about regular everyday people being connected via an online exchange. Accredited investors are not average people.

I have a very basic question. It looks like none of the P2P cover a significant loan amount. I’m referring to something along the lines of a home mortgage. Are there any that do, and such that they are actually worth making the move? For the rates quoted above there isn’t much gained for the borrower. At least in the US, it seems like a big portion of the lending woes are for mortgage holders that are stuck with their high rate loans and no way out. And yes, I fit that bill. If I had a better rate the monthly payments would be doable, but of course the bank has no vested interest in budging. A P2P loan that offered relief would be an option, but is that amount too much risk for the industry?

I agree. Another problem is for the people in the middle trying to buy a home for less than 50K. I cannot find anyone to even do a mortgage loan for less than that. Yet I cannot find any other type of loan that will give anymore than 5,000 which is not enough. I’m caught in the middle. I can easily afford a loan of 25K . Could easily buy a car for more than that. But to try and buy a house for 27K I’m screwed. And I think that is a better more secure type of loan to make over a car. Yet banks fund car purchases like water. I might as well buy an RV instead.

Hi Simon,

Thanks for the great writeup. Would it be wise to open accounts on both LC and Prosper as an investor? Main reason I ask is that I’m afraid of being in the risk of funding duplicate loans which a user opens on both sites, with more chances of defaulting. Is this pretty rare in regards to LC and Prosper knowing if a duplicate loan has already been started?

Thanks!

The Lending Club and Prosper websites indicate that Pennsylvania does not let investors invest in P2P lending. Are there any P2P websites that Pennsylvania DOES allow investing? (I googled PA Securities and Exchange Commission, but to no avail.)

Hi, I have a question for anyone who has the answer. I am considering investing on lending club and already have an acount. I suppose I could be convinced to move to prosper if there are significant advantages.

My main concern with P2P lending is that I’m wondering… When a loan is defaulted, what happens? Is it sent to collections? And if the loan is in fact purchased by a collections agency, does an investor regain all or some of their investment?

It seems to me that people can just go on to lending club and take out a loan and not pay it back and there are no consequences. Can that be true? Thank you.

Dear Peckmon,

Your assumption sounds correct for both LC and Prosper. A borrower defaulting with such a (consumer note) provides little or no recourse as the loan maintains no collateral compared to a real estate loan which is secured by the asset; the subject property.

So, other than Lending club and Prosper, what other p2p lending platforms have an API worldwide. Does anywon know’?

So does anyone have an opinion on which of these analytical sites (peercube, lending robot, peer lending server, interest radar, etc.) would be best? Something really good at buying the best notes that\’s easy to understand and use?

In my personal opinion, LendingRobot is the easiest to use. But you may want to ask around.

i like the way you write the blog with images

Thanks Marlon

Lending Club investors should not expect stock market returns. However, they should expect significantly lower volatility (in other words, risk). This is a classic example of risk/return trade off.